9 April 2024

Private Shares Trading

BDA Partners is pleased to be advising Asian corporates and their venture capital (VC) arms on selling their minority stakes in equity startups in the US and Europe.

We are responding to the growing trend of strategics investing in start-ups, often through corporate venture capital (CVC) arms.

BDA is addressing the demand for exits from these minority investments, given tight and challenging market conditions.

Interested buyers, notably secondary funds and family offices, can connect with sellers through this service. BDA’s experienced team ensures efficient transactions at optimal prices.

Private Shares Trading

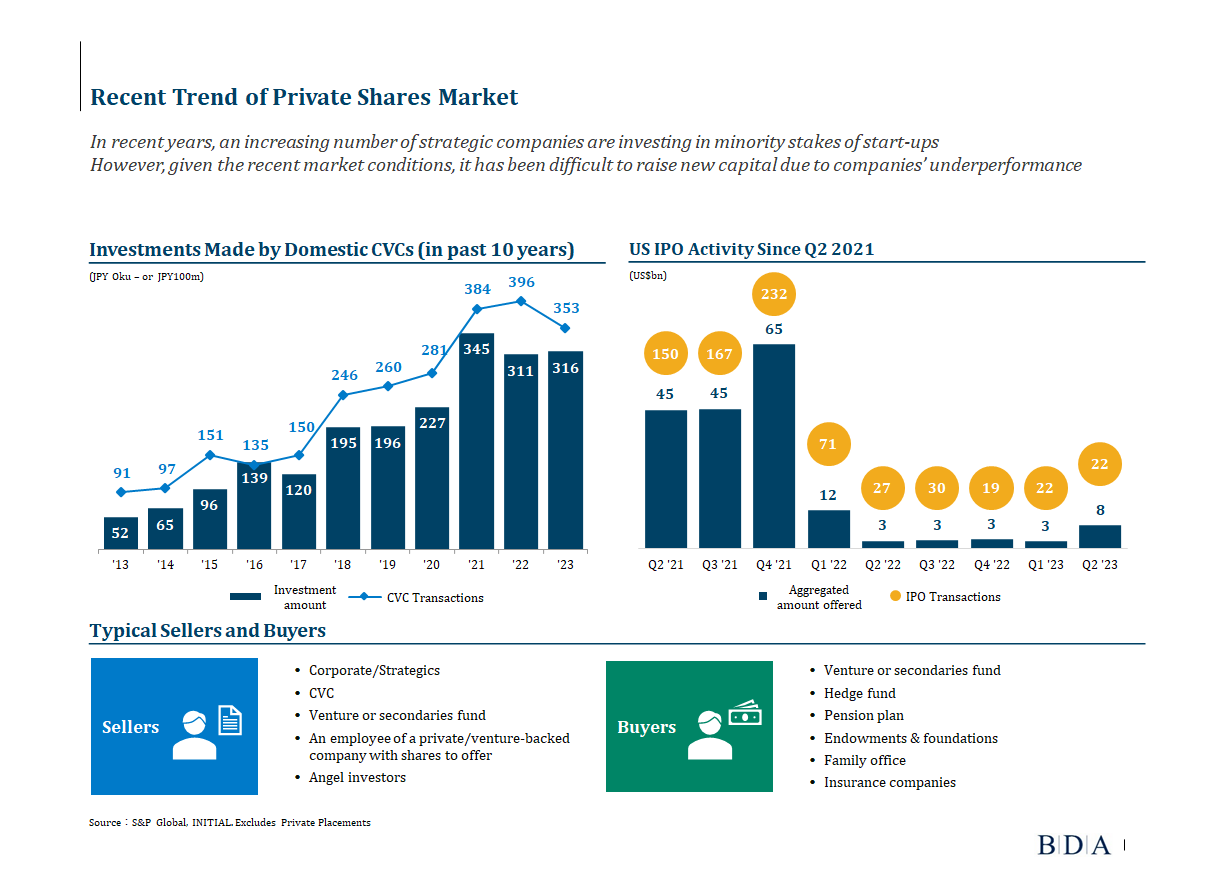

In recent years, an increasing number of strategics are investing in minority stakes in start-ups and growth companies in the US and Europe.

They use these stakes as a window into overseas innovations, and to invest in growing companies alongside prominent VCs.

However, given recent market conditions, it has been difficult to raise new capital. Growth companies’ have underperformed through the macroeconomic downturn, with smaller tech players often performing poorly on stock markets.

It’s difficult to raise new capital, and the number of IPOs has decreased. Even unicorns have failed to go public and struggled in the capital markets. Many corporates are therefore looking for ways to monetize their minority venture investments.

Our Private Share Trading team serves both buyers and sellers in the secondary market, with a comprehensive investor network. Our team allows transactions with the best investors at the best price. Secondary funds and family offices seeking bigger stakes in existing holdings, or acquisition of new positions, are increasingly investors and buyers for public and private securities.

About BDA Partners

BDA Partners is the global investment banking advisor for Asia. We are a premium provider of Asia-related advice to sophisticated clients globally, with over 25 years’ experience advising on cross-border M&A, capital raising, and financial restructuring. We provide global reach with our teams in New York and London, and true regional depth through our seven Asian offices in Mumbai, Singapore, Ho Chi Minh City, Hong Kong, Shanghai, Seoul, and Tokyo. BDA has deep expertise in the Chemicals, Consumer & Retail, Health, Industrials, Services, Sustainability and Technology sectors. We work relentlessly to earn our clients’ trust by delivering insightful advice and outstanding outcomes.

BDA Partners has strategic partnerships with William Blair, a premier global investment banking business, and with DBJ (Development Bank of Japan), a Japanese Government-owned bank with US$150bn of assets. bdapartners.com