2023年04月27日

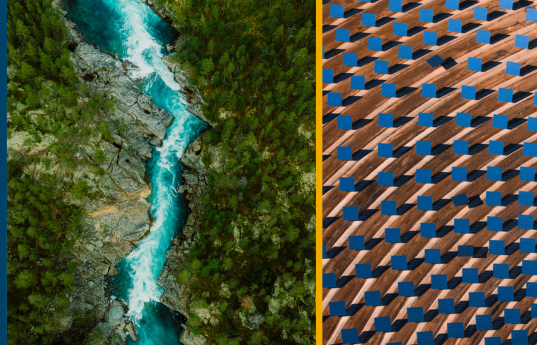

Solar in ASEAN; plugging the gap

Solar energy in ASEAN presents a compelling investment opportunity for both financial and strategic investors. This is a result of the recent (and potentially continuing) advances in technology and levelized cost of energy (“LCOE”) and the expected regulatory developments.

Energy demand in the ASEAN region:

- Back in 2018, Singapore’s Prime Minister Lee Hsien Loong stated, “ASEAN will become the fourth-largest economy in the world by 2030, after the US, China, and the European Union”

- This step change means the associated evolution in energy demand in ASEAN has global implications

- From 2012 to 2021, the region’s growth in power demand actually outpaced that of GDP by a factor of 1.2x

- This trend is set to continue, with regional electricity demand growth expected to surpass global average power growth by 1.5x from 2022 to 2031

Investment opportunities:

- ASEAN countries have laid out clear renewable energy capacity targets to reach the goals set out in the Paris Agreement and the associated Nationally Determined Contributions (“NDCs”)

- By 2025, these nations aim to have 23% of their primary energy supplied by renewable energy

- To meet this objective, annual investments in the ASEAN renewables sector are expected to at least double from current levels

- Thanks to regulatory developments and the falling relative LCOE, solar is emerging as the predominant renewable technology for ASEAN

- BDA expects private sector investment and corporate activity to accelerate and support the sector’s already rapid growth

About BDA Partners

BDA Partners is the global investment banking advisor for Asia. We are a premium provider of Asia-related advice to sophisticated clients globally, with over 25 years’ experience advising on cross-border M&A, capital raising, and financial restructuring. We provide global reach with our teams in New York and London, and true regional depth through our seven Asian offices in Mumbai, Singapore, Ho Chi Minh City, Hong Kong, Shanghai, Seoul, and Tokyo. BDA has deep expertise in the Chemicals, Consumer & Retail, Health, Industrials, Services and Technology sectors. We work relentlessly to earn our clients’ trust by delivering insightful advice and outstanding outcomes.

BDA Partners has strategic partnerships with William Blair, a premier global investment banking business, and with DBJ (Development Bank of Japan), a Japanese Government-owned bank with US$150bn of assets. bdapartners.com

Contacts

Lars Freitag

Senior Advisor

Singapore

Latest insights

2025年01月21日

Environmental services and waste management – expert interview with Howard...

BDA Partners advised IMM’s consortium on their successful US$1.6 billion...

2025年01月10日

Japan’s $230bn M&A boom will get even bigger: Jeff Acton quoted in...

Jeff Acton, Co-Head of Tokyo, BDA Partners, was quoted by Bloomberg. He...

2024年12月18日

“Asia private equity 2025 preview: exits and liquidity”; Euan Rellie...

BDA Managing Partner Euan Rellie spoke with MergerMarket about the year...

2024年12月12日

BDA’s Simon Kavanagh speaks to Bloomberg about Hong Kong’s...

Simon Kavanagh, Head of Industrials, BDA, was quoted in Bloomberg. Bloomberg...