China Private Equity Report 2023

China’s private equity (“PE”) industry faced strong headwinds in 2022 due to factors including a slowing economy, Covid-19 restrictions, increased regulatory scrutiny, and higher prevailing interest rates globally which weighed on public market valuations. PE exits and fundraising had been challenging during the past year.

However, the China market underwent a dramatic change in recent months as the country’s Zero-Covid policy was relaxed and borders were reopened. The Chinese government implemented measures to boost the economy and private sector investments. This report provides our perspectives on how these changes may impact PE activities and China M&A market in 2023.

The key takeaways in this report are:

- The unwinding of Zero-Covid policies will benefit sectors such as consumer, tourism, and property. China’s growth story will be back in focus and investor confidence in the Chinese economy will likely revive. Looking ahead, consumer & retail, manufacturing, energy & resources, life science & healthcare, and logistics & supply chain industries will likely attract the most attention

- China M&A market involving Financial Sponsors will be dominated by China GP’s investments in domestic targets. We also expect to see an increase in GP outbound investments in 2023 to diversify their portfolio outside of China

- Trade sales and IPOs were difficult in 2022, leading to delays in portfolio company exits and fundraising for PEs. In 2023, we expect to see a greater number of portfolio company exits, with more quality assets coming to the market. We expect tightened regulations and the long backlog for public listings will continue to pose difficulties for IPO exits, and mean trade sale will be a more prominent exit route for PEs in 2023

- PEs will likely focus on returning capital to LPs through portfolio company exits in 2023. We expect that fundraising will remain relatively subdued this year, followed by more fundraising activity from 2024 onwards as PEs complete more exits – and need to replenish their capital for new investments

About BDA Partners

BDA Partners is the global investment banking advisor for Asia. We are a premium provider of Asia-related advice to sophisticated clients globally, with over 25 years’ experience advising on cross-border M&A, capital raising, and financial restructuring. We provide global reach with our teams in New York and London, and true regional depth through our seven Asian offices in Mumbai, Singapore, Ho Chi Minh City, Hong Kong, Shanghai, Seoul, and Tokyo. BDA has deep expertise in the Chemicals, Consumer & Retail, Health, Industrials, Services and Technology sectors. We work relentlessly to earn our clients’ trust by delivering insightful advice and outstanding outcomes.

BDA Partners has strategic partnerships with William Blair, a premier global investment banking business, and with DBJ (Development Bank of Japan), a Japanese Government-owned bank with US$150bn of assets. bdapartners.com

A rapidly expanding middle class with increased health awareness post-pandemic will continue to fuel demand for higher standards in all aspects of healthcare in Vietnam, making the country a favorite investment destination. At BDA Partners, we have seen strong interest from both financial sponsors and strategic investors to gain exposure to the sector, and we believe that there remains an abundance of M&A opportunities across various healthcare verticals.

Healthcare services – Key M&A volume driver

Historically, transactions involving private hospitals and clinics have driven deal volume in Vietnam, and this theme is expected to persist given favorable market dynamics. Vietnam’s aging population with increased health awareness and growing income level have created unmet demands for high quality healthcare services. On the supply side, the issue of overcrowding at public hospitals in major cities persist. According to the General Statistics Office[1], Vietnam has 3.1 hospital beds per 1,000 population in 2021, below WHO’s recommended level (5 beds per 1,000 population). This supply-demand imbalance implies significant headroom for the expansion of private healthcare in Vietnam, supported by government policies such as Decision No.20/NQ-TW 2017[2], which sets the target for private hospital beds to account for 10% and 15% of the total number of hospital beds in 2025 and 2030, respectively. As a result, private hospitals and clinics will continue to generate significant interest, especially as patient volume is recovering to pre-pandemic level, while surgeries, complex procedures, and other high-value medical services have been reintroduced.

Notable trends

- General hospitals attracting the most interest: The largest transaction in healthcare services in recent years was GIC’s US$204m investment in Vinmec in 2020. Other notable transactions include VinaCapital’s investment in Thu Cuc in 2020, Quadria Capital’s investment in FV Hospital in 2017, and Navis’s investment in Hanoi French Hospital in 2016. Both strategic and financial investors have been looking for sizable transactions involving private general hospitals in Vietnam, many of which boast strong profit margins, healthy cash flow, and high occupancy rates. Notably, assets in the upper-mid and premium segments with service quality comparable to international standards have the potential to capture demand from the growing number of Vietnamese patients who would otherwise be traveling abroad for treatment.

- Growing emphasis on specialty assets: Regional healthcare platforms are looking for bolt-on acquisitions to add more specialties to their networks, following Heliconia’s investment in the ophthalmology network Mat Sai Gon and TPG’s investment in Hung Viet Oncology Hospital in 2019. Specialty clinics have also started to gain traction, as evidenced by the successful capital raises of Kim Dental from ABC World (a transaction in which BDA served as the exclusive financial advisor to Kim Dental) and Nhi Dong 315, a pediatrics and maternity chain, both of which having extensive, fast-growing networks of locations in HCMC.

- New focus on Tier 2 / Tier 3 cities: Foreign investors have demonstrated increased appetite for assets outside major cities, as evidenced by CVC’s acquisition of a 60% stake in Phuong Chau, a network of four hospitals in the Mekong Delta region in 2022 and Kei Mei Kai’s acquisition of Binh Duong-based Hoan Hao Hospital in 2019. Vietnam’s rapid urbanization will create significant demand for high quality healthcare services in Tier 2 / Tier 3 cities, making hospitals / clinics in those regions compelling investment opportunities.

- Appetite for healthcare platforms: Investors are on the hunt to scoop up scaled healthcare operators with multiple facilities in Vietnam, which are more attractive from a growth and profitability improvement perspective compared to single-location assets.

Pharmaceuticals – Favorable market conditions propelling strategic M&A partnerships

With no foreign ownership limit for pharmaceutical manufacturing, many local manufacturers have formed partnerships with foreign investors, with examples such as Taisho-DHG, Aska-Hataphar, SK-Imexpharm, and Daewoong-Traphaco. Per Decree No. 54/2017/ND-CP[3], foreign-invested entities cannot directly participate in pharmaceutical distribution in Vietnam, while still being able to distribute their locally produced products. This regulation makes investments in local manufacturers the most efficient way for foreign players to gain exposure to Vietnam’s pharmaceutical market, which is projected to reach US$16.1bn by 2026 per BMI Research[4].

Going forward, as a defensive sector, pharmaceuticals will receive strong interest amidst current global macroeconomic turbulence. The industry is set to benefit from the government’s strategy to promote domestic manufacturing, which aims to increase the share of locally produced pharmaceuticals to 80%[5], in a market historically dominated by imports. To boost competitiveness, local manufacturers will find M&A with foreign strategic investors as a viable strategic option, enabling them to meet global standards through transfers of technology, corporate governance, and management expertise. Meanwhile, investors are targeting manufacturers in Vietnam to capture local market potential and export opportunities through contract manufacturing partnerships.

Others – Emerging verticals with headroom for growth

Healthtech

The decrease in direct interaction due to the pandemic has brought healthtech into the spotlight, given increased demand for virtual healthcare services. Remote medical examinations and digitalization of medical records have been among the key focuses of the Vietnamese government. Meanwhile, in the private sector, healthtech startups serving various verticals of the market such as telehealth (JioHealth, Med247, eDoctor), third party administration (Insmart, South Asia Services), and e-pharmacy (Medici, POC Pharma) have recently successfully raised funding from foreign investors, highlighting the prospect of the nascent healthtech segment in Vietnam. However, healthtech is still trailing other tech-related sectors such as payment or e-commerce in investments and development progress, and there is still ample room for investors to participate in the value creation process.

Diagnostics

The diagnostics market in Vietnam is still highly fragmented, with most players in the market being mom-and-pop labs with limited scale, low volume, and outdated technology. Thus, companies that can create scalable, modern, and tech-enabled networks of diagnostic services to capture market share will appeal to investors as good anchor assets for the creation of pathology platforms, similar to what happened in regional markets such as India and China. In addition to clinical diagnostics, genetic testing has also appeared on investors’ radar, with companies such as Genetica and Gene Solutions having completed their early funding rounds and Gentis being acquired by Eurofins.

Medical equipment

There are still few local manufacturers that meet international standards – more than 90 percent of medical equipment in Vietnam is imported, according to the Ministry of Health[6]. Nevertheless, the recent US$30m investment in 2022 by Eastbridge Partners in USM Healthcare, a local stent manufacturer, signifies that high quality assets in this space will still generate good traction. This sector will be an interesting one to watch, especially in the medical consumables segment (e.g., stents, sutures, etc.), which is more prevalent among local assets.

Looking ahead

From our recent interaction, healthcare regularly features among the key focuses of financial sponsors. Given favorable sector trends, financial sponsors are going to capitalize on and exit their investments, while also remaining as active investors due to accumulated dry powder and pent-up dealmaking demand after the pandemic. On the other hand, strategic investors will continue to closely monitor suitable opportunities to invest in synergistic assets in Vietnam. Investors with existing presence in Vietnam or in markets with similar levels of development will have an advantage through their deep understanding of market intricacies and strong operational know-how, to quickly integrate with potential targets.

In conclusion, we remain confident in the availability of M&A opportunities in Vietnam’s healthcare market going forward, especially now that Covid-related impacts that created valuation gaps and diligence challenges should no longer remain as obstacles. We look forward to a busy period ahead in 2023 with our ongoing live deals and strong pipeline of opportunities in the sector.

[2] https://thuvienphapluat.vn/van-ban/The-thao-Y-te/Nghi-quyet-20-NQ-TW-2017-tang-cuong-cong-tac-bao-ve-cham-soc-nang-cao-suc-khoe-nhan-dan-365599.aspx

[3] https://thuvienphapluat.vn/van-ban/The-thao-Y-te/Decree-54-2017-ND-CP-guidelines-for-implementation-of-the-Law-on-Pharmacy-356336.aspx

[4] https://gmp.com.vn/thi-truong-duoc-pham-viet-nam-2021:-trien-vong-han-che-va-nhung-xu-huong-n.html

[5] https://vietnamnews.vn/economy/772550/support-for-domestic-pharmaceutical-industry-to-rise-in-viet-nam.html

[6] https://www.vietnam-briefing.com/news/vietnams-medical-devices-industry-opportunities-for-european-businesses.html/

About BDA Partners

BDA Partners is the global investment banking advisor for Asia. We are a premium provider of Asia-related advice to sophisticated clients globally, with over 25 years’ experience advising on cross-border M&A, capital raising, and financial restructuring. We provide global reach with our teams in New York and London, and true regional depth through our seven Asian offices in Mumbai, Singapore, Ho Chi Minh City, Hong Kong, Shanghai, Seoul, and Tokyo. BDA has deep expertise in the Chemicals, Consumer & Retail, Health, Industrials, Services and Technology sectors. We work relentlessly to earn our clients’ trust by delivering insightful advice and outstanding outcomes.

BDA Partners has strategic partnerships with William Blair, a premier global investment banking business, and with DBJ (Development Bank of Japan), a Japanese Government-owned bank with US$150bn of assets. bdapartners.com

Huong Trinh, Partner and Head of Ho Chi Minh City at BDA Partners, shares insights on Vietnam F&B sector in M&A on VIR.

How do you see the trend of M&As in Vietnam’s F&B post-COVID? Do you see a slowdown in this area?

Post-Covid, we are still observing continuing interests from both strategic and financial investors, especially ones from Japan, Korea, and Southeast Asia for F&B companies in Vietnam. The total value of M&A transactions in Vietnam’s consumer sector reached US$1.2bn in 10M2022, an increase of nearly 40% yoy from US$871m in 10M2021. Meanwhile, it is worth noting that in recent months in 2H 2022, consumer confidence has been impacted by ongoing macro factors (e.g., surging inflation and interest rates). Nevertheless, going forward, we still expect a buoyant F&B market outlook, as Vietnam remains as one of the most attractive F&B markets in the region with robust market fundamentals and a strong socioeconomic backbone thanks to (i) a fast-growing market with 100 million consumers, propelled by robust economic growth and rising income, (ii) a young and dynamic population increasing propensity to spend, and (iii) rising demands for e-commerce and modern retail driven by rapid urbanization. These are the key factors driving M&A activities in the Vietnam’s F&B sector.

Filipino food company Jollibee Food Corporation is reportedly seeking to sell a minority stake in Vietnamese coffee chain Highlands Coffee. The sale could lead to an IPO launch for the coffee chain, which Jollibee has been considering for several years. What are the opportunities for foreign companies to conduct M&As in Vietnam’s F&B market? What are some major F&B deals in Vietnam in 2022?

We believe there remain many opportunities for foreign investors looking for potential targets for M&A of F&B companies in Vietnam, given the strong growth prospects. Strategic investors will be on the hunt for Vietnamese F&B companies to expand their product portfolio, manufacturing capacity and distribution network in the country. Such investments will also provide strategic investors quick access to a highly potential F&B market with 100 million consumers with rapidly growing disposable income. This attractive market outlook will also appeal to financial sponsors, especially ones with strong track record of operational expertise in the sector.

Additionally, in Vietnam, there is generally no restriction/limit on foreign ownership applicable to F&B companies. This opens various opportunities for foreign investors to penetrate Vietnam market via M&A, especially for those who prefer to seek controlling stakes in the target companies.

From our discussions with investors within our network, sub-segments in the F&B sector that we continue to see strong interests from foreign investors are food service, food ingredients and additives, and F&B retail. Vietnam F&B companies with (i) strong brand equity and awareness, (ii) extensive portfolio of staple products that are less directly affected by market fluctuations, (iii) nationwide distribution network, (iv) healthy financial performance, and (v) clearly defined business plans with attractive growth initiatives will present compelling investment opportunities for foreign investors.

Some remarkable F&B transactions in 2022 include:

- Masan Group’s acquisition of a majority stake in Phuc Long

- Swire Pacific’s acquisition of Coca-Cola bottling operations in Vietnam and Cambodia for c.US$1bn

- Golden Gate minority equity stake sale to a group of investors led by Temasek

- Navis invested over US$100mn in Dan-D Foods for the majority stake of the company.

- Pan Group has bought 39.9% stake in Bibica for US$22.6mn to increase its total ownership to 98.3%.

- Cool Japan Fund’s minority stake investment into Pizza 4P’s, following the successful divestment of Mekong Capital

Vietnam Dairy Products JSC (Vinamilk) and Kido Group JSC have just announced the suspension and dissolution of the joint venture Vibev. Could you comment on the dissolution of the F&B joint venture? What are challenges for F&B players to restructure their M&A strategies post-COVID?

The current regional and local macro situations may impact corporate considerations and decisions on business plans, including what should be the strategic focus for 2023 and onwards. These are also mentioned in Kido and Vinamilk’s statements regarding the dissolution of their JV. There are various aspects that F&B companies should carefully consider, so that their M&A activities (i) can be aligned with corporate strategies, and (ii) can add long-term synergistic value to the Company and stakeholders.

Some key challenges/considerations for F&B players regarding their M&A strategies include:

| Challenges | Mitigations and opportunities |

| For sellers | |

| How to align and balance the value from long-term M&A strategies with current business requirements | In some cases, shareholders or companies may have to choose between long-term strategic value and immediate capital needs. Nevertheless, F&B companies should always carefully consider such synergistic values that an investor may contribute to the development and expansion of the business (other than capital), when it comes to selecting the right strategic partner for M&A. Those values can be global best practices in corporate governance, know-hows in operations, network relationships or product portfolio expansion, etc. |

| Business performance can be impacted by macro factors (e.g., higher inflation and interest rates, which may impact valuation) | Valuation can be based on future performance or normalized current performance rather than current accounting performance. In such case, companies need to have a clear explanation for its performance during COVID period and a normalized level of performance. Companies with clearly defined business plans and well-established growth initiatives will be able to deliver more attractive growth stories and will be more likely to solicit better valuation/terms from investors. Companies should also keep in mind about the timing for M&A, so that investors may have sufficient time to understand and appreciate the business and growth potentials, before making an investment decision. Professional M&A sell-side advisors may help shareholders and the Company with fine-tuning the equity story and articulating growth prospects to potential investors to maximize value. |

| How to be well prepared to maximize value from M&A transactions | It can be time-consuming to prepare for an M&A transaction. To fully appreciate the business, investors will need to review an extensive level of company’s information, including historical and forecast financials, and detailed business plan. As such, companies should be well prepared in terms of available information that can be shared with investors before going to market for M&A. |

| For buyers | |

| How to identify and select the right targets for acquisition, and how to integrate long-term growth directions with M&A strategies amidst recent market fluctuations | Both strategic investors and financial sponsors should maintain a clear pipeline of potential targets in the wishlist and be prepared to have sufficient funding for prompt deployment when good opportunities become available (which usually involve strong competition). |

| Portfolio performance review and non-core business considerations | Companies should constantly review performance of portfolio companies and identify under-performing or non-core businesses for further action. This is to ensure that M&A activities actually bring value to the group business, and that most (if not all) investments align with the company’s strategic directions. Divestment of under-performing or non-core may be considered. |

About BDA Partners

BDA Partners is the global investment banking advisor for Asia. We are a premium provider of Asia-related advice to sophisticated clients globally, with over 25 years’ experience advising on cross-border M&A, capital raising, and financial restructuring. We provide global reach with our teams in New York and London, and true regional depth through our seven Asian offices in Mumbai, Singapore, Ho Chi Minh City, Hong Kong, Shanghai, Seoul, and Tokyo. BDA has deep expertise in the Chemicals, Consumer & Retail, Health, Industrials, Services and Technology sectors. We work relentlessly to earn our clients’ trust by delivering insightful advice and outstanding outcomes.

BDA Partners has strategic partnerships with William Blair, a premier global investment banking business, and with DBJ (Development Bank of Japan), a Japanese Government-owned bank with US$150bn of assets. bdapartners.com

Huong Trinh, Partner and Head of Ho Chi Minh City at BDA Partners, shares insights on the real estate and logistics market in M&A on DealStreetAsia.

“Accumulated dry powder and pent-up dealmaking lead to increased demand across all segments of the real estate market, with residential and industrial properties and projects attracting the most interest in 2022.”

“There is still ample headroom for development and investment opportunities in the segment, as Vietnam still needs to fill the demand of foreign corporations for the modernisation of industrial facilities to catch up with global standards and the introduction and integration of tech-enabled supply chain and logistics networks throughout the country,” said Trinh of BDA Partners.

In the short-term, M&A in real estate in Vietnam will be impacted by overall uncertainty in the macroeconomic environment and tightening of liquidity in the market, as the “easy money” period has come to a temporary halt, said Trinh of BDA Partners.

“Given tight liquidity available in the local banking and corporate bond system, we believe that there are opportunities for regional private credit funds, which have not been popular in Vietnam in the past, to penetrate the market,” she said.

Investors, Trinh went on, will require higher interest rates and more liquid assets to be used as collateral, reflecting the downgraded market outlook.

According to BDA Partners, foreign investors will continue to hunt for investments in both real estate projects and developers, driven by clear opportunities to capitalize on incumbent market potential in Vietnam’s fast-growing and transforming economy.

About BDA Partners

BDA Partners is the global investment banking advisor for Asia. We are a premium provider of Asia-related advice to sophisticated clients globally, with over 25 years’ experience advising on cross-border M&A, capital raising, and financial restructuring. We provide global reach with our teams in New York and London, and true regional depth through our seven Asian offices in Mumbai, Singapore, Ho Chi Minh City, Hong Kong, Shanghai, Seoul, and Tokyo. BDA has deep expertise in the Chemicals, Consumer & Retail, Health, Industrials, Services and Technology sectors. We work relentlessly to earn our clients’ trust by delivering insightful advice and outstanding outcomes.

BDA Partners has strategic partnerships with William Blair, a premier global investment banking business, and with DBJ (Development Bank of Japan), a Japanese Government-owned bank with US$150bn of assets. bdapartners.com

The FinTech sector in Southeast Asia (SEA) has been flourishing in recent years, with ever-increasing capital flowing into the region from global investors and market leaders. In our latest insight, we take a closer look at the key trends that make SEA an attractive FinTech market, the dynamics within key FinTech verticals, and how we expect financing activity to evolve.

Key takeaways:

State of the Tech markets

- Global equities are experiencing high volatility and have been roiled over inflation fears, rising geopolitical tensions, and escalating interest rates

- High-growth companies are witnessing the greatest share price declines (>50%) as cash flows far out into the future are discounted harder, amid rate hikes

- While public Tech valuations appear to have plummeted, they have in fact eased down to the 10-year historical baseline

- The pace of private capital deployment may have moderated relative to 2021, but remains vigorous and surpasses that of all preceding years

- All-time high dry powder in 2022 is expected to fuel continued deal velocity

SEA FinTech landscape and exit thoughts

- SEA is one of the most vibrant Tech ecosystems globally with a booming FinTech sector

- Singapore and Indonesia account for two-thirds of SEA FinTech deals

- Payments and lending drive more than half the region’s FinTech deals by value; crypto/web3 companies have been gaining traction among earlier-stage investors amid growing institutional awareness

- Mounting unrealised value at a time when public listings/SPACs have lost their shine as a viable, attractive exit route

- Private financing rounds/M&A are expected to intensify over the longer term as the ecosystem matures and more investors flock to SEA to tap into the region’s growth, talent, and disruptive business models

Download the full report

About BDA Partners

BDA Partners is the global investment banking advisor for Asia. We are a premium provider of Asia-related advice to sophisticated clients globally, with over 25 years’ experience advising on cross-border M&A, capital raising, and financial restructuring. We provide global reach with our teams in New York and London, and true regional depth through our seven Asian offices in Mumbai, Singapore, Ho Chi Minh City, Hong Kong, Shanghai, Seoul, and Tokyo. BDA has deep expertise in the Chemicals, Consumer & Retail, Health, Industrials, Services and Technology sectors. We work relentlessly to earn our clients’ trust by delivering insightful advice and outstanding outcomes.

BDA Partners has strategic partnerships with William Blair, a premier global investment banking business, and with DBJ (Development Bank of Japan), a Japanese Government-owned bank with US$150bn of assets. bdapartners.com

Although COVID-19 did not completely hamper M&A deal flow in Vietnam, travel restrictions and a strict lockdown in the second half of 2021 posed major challenges for buyers and sellers alike. With the gradual unwinding of COVID-related restrictions and the resumption of international flights in October 2021, M&A activity has accelerated. The economy has recovered quickly and the outlook for dealmaking is positive.

Top 10 M&A transactions in Vietnam (October 2021 – August 2022)

| Date | Investor | Target | Deal size (US$m) | Stake |

| Oct-21 | SMBC Consumer Finance | FE Credit | 1,400 | 49% |

| Jul-22 | Swire Pacific | Coca-Cola Indochina | 1,015 | 100% |

| Dec-21 | TPG, Temasek, ADIA | The CrownX | 350 | 4% |

| Nov-21 | SK Holdings | The CrownX | 345 | 5% |

| Dec-21 | Mizuho | Momo | 200 | Undisclosed |

| Feb-22 | AC Energy | Super Energy’s nine solar plants | 165 | 49% |

| Oct-21 | UBS, Mirae, STIC | Tiki | 136 | Undisclosed |

| Apr-22 | Hana Financial Group | BIDV Securities | 118 | 35% |

| Aug-22 | Masan | Phuc Long | 155 | 34% |

| Apr-22 | Indorama Ventures | Ngoc Nghia Industry | 94 | 98% |

Source: Mergermarket

Key drivers propelling post-pandemic deal flow

Vietnam’s economic recovery has proven appealing to investors – it was one of the few countries that recorded two consecutive years of GDP growth in 2020 and 2021 during the height of COVID. According to the General Statistics Office, Vietnam achieved 2.58% GDP growth in 2021[1], despite experiencing one of the strictest lockdowns in the world during the second half of that year. Looking ahead, the Asian Development Bank is forecasting that Vietnam’s economic growth will recover to 6.5% in 2022[2]. In fact, GDP growth in Q2 2022 was 7.7%, the highest quarterly growth in the last ten years.[3]

Pent-up dealmaking demand is a key driver. Both strategic investors and financial sponsors have a large amount of capital to invest and are keen to identify new opportunities or revive discussions that were on hold. Industry leaders are actively looking for acquisitions to consolidate market share within their verticals, taking advantage perhaps of competitors weakened by COVID and slower to rebound. In addition, many companies are looking to position themselves for recovery in the post-pandemic economy and need new capital injections for internal transformation and further growth in order to remain competitive.

The resumption of international travel is also significant. In-person due diligence and site visits have facilitated many deals that were previously put on hold, especially for asset-heavy industries such as industrials, logistics, and healthcare. Since October 2021, BDA has met with numerous foreign investors who have expressed a strong interest in Vietnam. After a two-year hiatus, BDA organised its annual networking event in Ho Chi Minh City in May 2022 with over 200 participants – mainly investors and corporate shareholders – and all appreciated the opportunity to reconnect in person and discuss the future.

Trends expected to persist post COVID

Domestic investors had an advantage over their foreign counterparts during COVID given their local presence, and this led to an increase in domestic deal flow and volume. Although COVID-related border restrictions have now been lifted, BDA has seen local conglomerates continuing their acquisition spree in a market that has historically been dominated by foreign buyers. For example, in addition to its investment in Phuc Long, Masan also acquired a 25% stake in Trusting Social, a company engaged with credit scoring based on social data, for US$65m in April 2022. This was another transaction in which BDA acted as the exclusive advisor to the target company. Nova Group has been on an acquisition spree, expanding its ecosystem with a focus on Consumer businesses, having acquired and taken over the operations of major F&B establishments such as Jumbo Seafood, Sushi Tei, Crystal Jade, and PhinDeli.

From a deal negotiation perspective, BDA has observed several points that have become particularly important during deal negotiations. With material adverse change (“MAC”) clauses, buyers and sellers now need to acknowledge the risk of a significant downturn in the business as a result of COVID. MAC provisions typically exclude market-wide macroeconomic impact, but since COVID has different effects on different industries, the negotiation of specific triggers in MAC clauses needs to be scrutinised. Earn-outs have become more common by bridging valuation gaps under scenarios of temporary uncertainty, while also enabling sellers to share in the upside of long-term growth. Warranty and indemnity (“W&I”) insurance, a rare option in Vietnam deals in the past, is also being used more frequently, as both buyers and sellers appreciate the benefit of a smoother and faster signing and closing process.

During the height of domestic lockdown and border restrictions in 2021, virtual interaction was the only option in most cases for M&A transactions in Vietnam. We expect that for non-key discussions, virtual meetings will continue to be a common option in the future. However, for other key parts of the transaction process such as site visits and due diligence, which were supported by on-the-ground advisors and virtual tours during COVID, and especially for negotiations, in-person participation will still be preferred going forward.

Global slowdown in M&A in 2022 and beyond

Global M&A in H1 2022 is down 21% by value and 17% by volume compared H1 2021[4], partly due to the cooldown in SPAC-related transactions. Inflationary pressure across the supply chain, geopolitical tensions, and a rising interest rate environment have also contributed to the volatility that could become a recurring theme in the M&A market over the next year or so.

Inasmuch as businesses in Vietnam are not immune to these factors, we still believe that 2022 will remain another busy year for Vietnam’s M&A market. Investors have not shown any reduced appetite in dealmaking in Vietnam, as evidenced in their interest in BDA’s ongoing mandates. We believe that there are a lot of high-quality assets that have proven resilient against turbulence brought about by COVID that are now well-positioned for robust growth, and we look forward to a busy period ahead with a long list of current live deals and ongoing opportunities.

Tailwinds for future growth in M&A in Vietnam include:

- Strong socio-economic backbone: Vietnam will still benefit from steady economic growth, political stability, and a bourgeoning middle class population. Participation in multiple free trade agreements and open-market policies make Vietnam an attractive destination for foreign investment

- Rising importance as a manufacturing hub: More global corporations are expected to relocate to Vietnam, as the country has made significant progress in infrastructure development to catch up with international standards, with major investments from both public and private sectors. The US-China trade war and prolonged COVID restrictions in China have also led to more manufacturers moving operations to Vietnam

- Improving regulatory landscape: It is worth noting that with regards to M&A regulation and processes, local authorities have continuously been improving their turn-around time, while working towards clearer guidelines. For example, Decree 155/ND-CP guiding the implementation of the Law on Securities, which took effect in 2021, has provided additional clarification and detailed guidance with regard to the public tender offer process and foreign ownership limits

- Growing familiarity with M&A: Local businesses are becoming more professional with strong management teams and better corporate governance. Vietnamese companies are now more familiar with M&A concepts and are open to consider strategic partnerships with foreign investors, who can provide support through best practices in business operations and have extensive experience from global markets

Most attractive sectors in Vietnam for M&A

Consumer

- The Consumer sector will continue to be one of the main drivers of transaction volume

- Investors will target Vietnam as one of the fastest growing economies in the region, with its growing middle class and a young population with increasing income and propensity to spend

Healthcare

- In response to the lack of capacity within the national healthcare system, there has been an ongoing shift in demand towards private care

- Private hospitals will continue to attract interest from both strategic and financial investors, especially as patient volumes and occupancy rates are recovering to pre-COVID levels, while more profitable surgeries and procedures are reintroduced

Education

- Within private education, both local and international schools received significant interest from investors before COVID emerged

- We expect discussions regarding education assets will be restarted in the near future, as the businesses’ performance recover now that students of all levels have returned to the classrooms

Logistics

- Tailwinds from high growth in exports, a booming Internet economy, and supply chain shift from China will continue to propel growth in Vietnam’s logistics industry

- Assets in warehousing (especially smart logistics) and cold chain will generate strong interest from global investors

Financial Services

- An underbanked population with a shortage of financing and credit solutions will spur further investments in financial services

- The focus will be on consumer finance / fintech companies that provide solutions to enable access to non-bank credit for both individuals and micro, small, and medium businesses

Renewable Energy

- With a rapidly growing economy, Vietnam has been at risk of power shortages due to a lack of power infrastructure.

- Capital injections into the development of renewable energy could provide a suitable solution. Attractive feed-in-tariffs and untapped potential in solar and wind power capacity will make Vietnam an attractive destination for investors

[1] https://e.vnexpress.net/news/business/data-speaks/vietnam-finishes-2021-with-2-58-pct-gdp-growth-4409596.html

[2] https://www.adb.org/countries/viet-nam/economy

[3] https://baochinhphu.vn/gdp-quy-ii-2022-tang-truong-772-102220629090231152.htm

[4] https://www.allenovery.com/en-gb/global/news-and-insights/publications/global-ma-transactions-drop-over-20-percent-but-bright-spots-remain

About BDA Partners

BDA Partners is the global investment banking advisor for Asia. We are a premium provider of Asia-related advice to sophisticated clients globally, with over 25 years’ experience advising on cross-border M&A, capital raising, and financial restructuring. We provide global reach with our teams in New York and London, and true regional depth through our seven Asian offices in Mumbai, Singapore, Ho Chi Minh City, Hong Kong, Shanghai, Seoul, and Tokyo. BDA has deep expertise in the Chemicals, Consumer & Retail, Health, Industrials, Services and Technology sectors. We work relentlessly to earn our clients’ trust by delivering insightful advice and outstanding outcomes.

BDA Partners has strategic partnerships with William Blair, a premier global investment banking business, and with DBJ (Development Bank of Japan), a Japanese Government-owned bank with US$150bn of assets. bdapartners.com

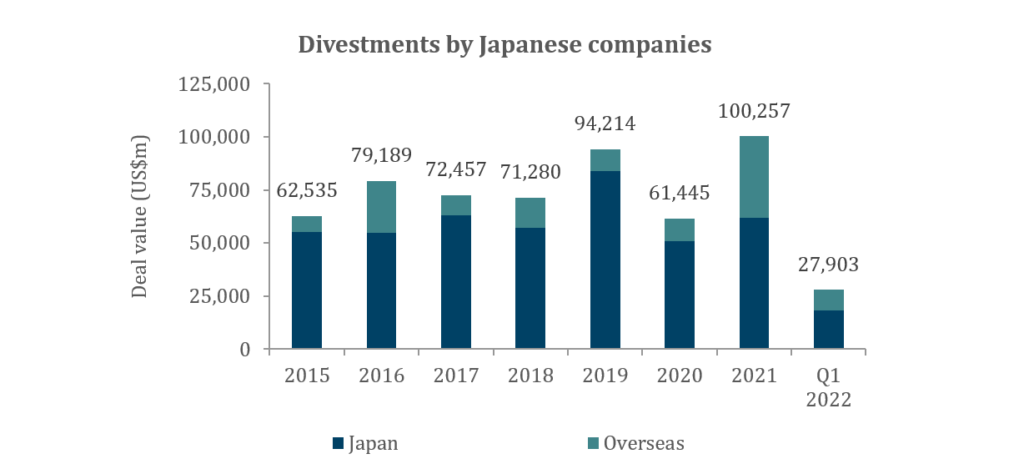

In the last few years, several trends have gained traction in Japan’s M&A market. The trends had already begun to take hold before COVID, which did not slow their development. In our latest insight, we take a closer look at three of the most significant trends, which are interrelated and are driving one another: 1) divestments by Japanese companies; 2) the ever-increasing activity of PE funds; and 3) the growing influence of activist funds.

Key takeaways:

Japanese companies are increasingly willing to divest non-core subsidiaries and assets, driven by changing perceptions about corporate divestments

- This has been led by large-cap companies so far, but smaller companies are expected to join as they also begin to appreciate the benefits

Divestments by Japanese companies are proving to be fruitful targets for PE funds, who are aggressively entering Japan market and raising record levels of capital

- Many corporate carveouts in Japan over the last few years have seen PE funds emerge as the successful acquirer

Another set of investment funds, activist investors, have stepped up their activity in Japan, embarking on campaigns against large companies to pressure them to increase corporate value

- A common demand of activist campaigns is the divestment of non-core assets, which feeds into the first trend, thus continuing the cycle

Source: Dealogic

Download the full report

Download the full report in Japanese

About BDA Partners

BDA Partners is the global investment banking advisor for Asia. We are a premium provider of Asia-related advice to sophisticated clients globally, with over 25 years’ experience advising on cross-border M&A, capital raising, and financial restructuring. We provide global reach with our teams in New York and London, and true regional depth through our seven Asian offices in Mumbai, Singapore, Ho Chi Minh City, Hong Kong, Shanghai, Seoul, and Tokyo. BDA has deep expertise in the Chemicals, Consumer & Retail, Health, Industrials, Services and Technology sectors. We work relentlessly to earn our clients’ trust by delivering insightful advice and outstanding outcomes.

BDA Partners has strategic partnerships with William Blair, a premier global investment banking business, and with DBJ (Development Bank of Japan), a Japanese Government-owned bank with US$150bn of assets. bdapartners.com

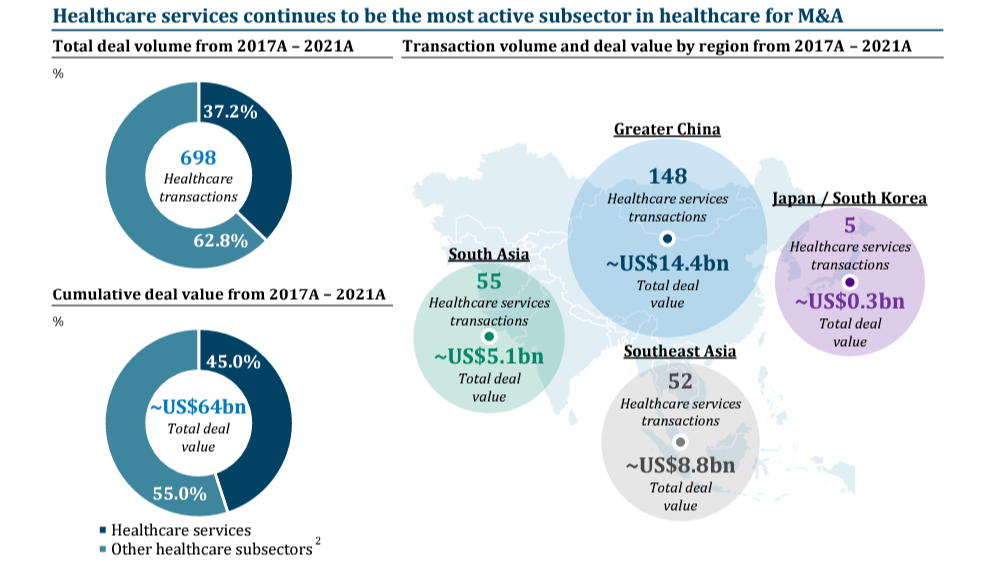

As an increasing number of countries in Asia achieve an 80% vaccination rate, they are gradually removing COVID-19 social and border restrictions. BDA Partners is revisiting the fundamentals and attractiveness of the Asian healthcare services sector.

Healthcare services is the largest part of the healthcare industry in Asia. Its market size is expected to reach US$1.4tr by 2026[1], driven by a growing population, rising affluence, and a mounting disease burden.

Key takeaways:

- Demand for healthcare services in Asia will continue to rise — the segment is growing at a faster pace than the overall healthcare industry, although healthcare infrastructure has been under-invested historically

- Even as governments across Asia increase their budget allocation to healthcare, the private sector continues to play an important role, providing capital and improving the efficiency of the healthcare system

- Financial sponsors have been, and will continue to be, active buyers of quality hospitals and healthcare services assets. Sponsors have been involved in 25% of healthcare services transactions from 2017-2021

- The global dry powder of private equity funds reached a new record of US$1.8tr in February 2022, following a record year of fundraising

- Asian M&A activity in the next two to three years will be strong, driven by consolidation and bolt-on acquisitions by strategics in their core markets, and investments by financial sponsors into both platform and growth companies

In this piece, we examine post-COVID sector trends and M&A activities in SE Asia, Greater China, and India.

Sources: Mergermarket

Note: (2) Other healthcare subsectors include Medical Devices, Medical Equipment & Services, Biotechnology Research, Drug Development, Drug Manufacturing, Drug Supply, Handicap Aids and Basic Healthcare Supplies, etc.

Download the full report

Contact BDA health team

Andrew Huntley, Managing Partner, Global Head of Healthcare, London / Ho Chi Minh City: ahuntley@bdapartners.com

Anthony Siu, Partner, Co-Head of Shanghai: asiu@bdapartners.com

Sanjay Singh, Managing Director, Head of India, Co-Head of Asia Healthcare: ssingh@bdapartners.com

Claire Zhen, Director, Shanghai: czhen@bdapartners.com

Aditya Jaju, Vice President, Mumbai: ajaju@bdapartners.com

Yan Xia, Vice President, Singapore: xyan@bdapartners.com

Zhang Simeng, Vice President, Shanghai: szhang@bdapartners.com

[1] Fitch and Statista

About BDA Partners

BDA Partners is the global investment banking advisor for Asia. We are a premium provider of Asia-related advice to sophisticated clients globally, with over 25 years’ experience advising on cross-border M&A, capital raising, and financial restructuring. We provide global reach with our teams in New York and London, and true regional depth through our seven Asian offices in Mumbai, Singapore, Ho Chi Minh City, Hong Kong, Shanghai, Seoul, and Tokyo. BDA has deep expertise in the Chemicals, Consumer & Retail, Health, Industrials, Services and Technology sectors. We work relentlessly to earn our clients’ trust by delivering insightful advice and outstanding outcomes.

BDA Partners has strategic partnerships with William Blair, a premier global investment banking business, and with DBJ (Development Bank of Japan), a Japanese Government-owned bank with US$150bn of assets. bdapartners.com

There has been a distinct focus on ESG and sustainability in Asian private equity deal activity in the first half of 2022, with implications for new investments, portfolio management and exits. We have seen this trend accelerate as we advise on a series of such transactions this year.

Asian sponsors are evaluating deals through an ESG lens

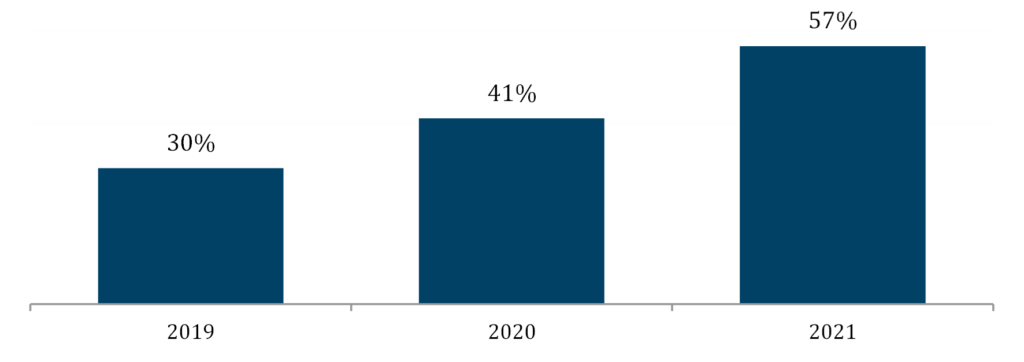

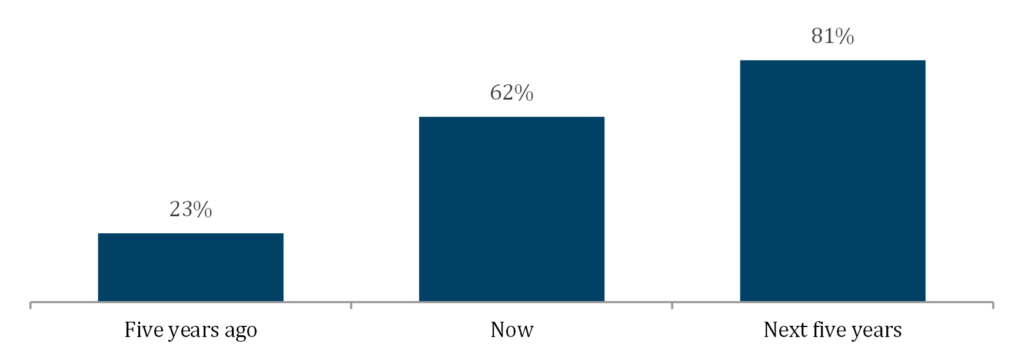

Western sponsors have thus far largely led the way on ESG considerations in M&A, with their APAC counterparts lagging behind. According to a recent Bain[1] survey, only 65% of APAC sponsors expect their LPs to scrutinise ESG issues over the next three years, compared to 96% and 80% for North America and Europe respectively.

However, the ESG agenda in Asian business is now picking up significant momentum. The survey[2] also found 57% of Asian GPs plan to materially increase their ESG efforts over the next three to five years, up from 30% in 2019. This goes beyond just compliance and regulatory reporting, with more and more funds adopting an explicit – and exclusive – focus on new investments that will have both a positive impact and generate higher financial returns.

These twin goals are no longer seen as contradictory, rather, self-reinforcing. In a McKinsey Global Survey[3], C-suite leaders indicated they would be prepared to pay a 10% premium to acquire a company with a positive ESG track record versus a company without one. Furthermore, the consensus was that ESG programmes created value over the short and long term.

PE funds are proactively issuing ESG/sustainability related reports (i.e. EQT, Partners Group, Carlyle, and Permira, all with a major presence in Asia) which have started to disclose ESG measurements at the fund and portfolio company level, including scope 1 and 2 carbon emissions, energy consumption, diversity and inclusion metrics, corruption, etc. Those that have set up an ESG reporting framework and roadmap for each portfolio company across the investment lifecycle will be better placed for a successful exit.

Asian GPs: increasing their focus on ESG / Sustainability

Asian GPs: % of assets evaluated with ESG due diligence

Source: Bain Asia-Pacific Private Equity Report 2022

Deal types

Robust and high ESG standard gives an investment opportunity a competitive edge, without which will greatly hinder financial sponsors’ deal appetite, whether deploying dedicated “impact-labelled” funds or generalist capital. We have witnessed exceptional demand for ESG-oriented business models in 2022 such as: validation of supply chains and workforce conditions, responsible electronic waste recycling and a range of renewable energy plays. Conversely, the manufacturing of consumer items that lack a sustainability narrative find it harder to navigate the investment committee stage. Investment committees are also putting greater focus on ESG at the M&A decision making stage and more are avoiding certain end markets with a high carbon intensity.

“BDA is building a solid track record in sustainable infrastructure and services in Asia, and globally for Asian clients.”

Lars Freitag, Managing Director and Head of Sustainability: Services & Infrastructure, BDA Partners

Renewable Energy

E-waste Recycling & IT Asset Disposition

ESG & Supply Chain Services

Exit implications for PEs

ESG is now front and centre in both M&A due diligence and the value creation playbook.

For M&A due diligence, the role ESG plays can vary from a simple red flag checklist to a dedicated ESG vendor due diligence report (with comparisons to market competitors, emissions calculations etc.) or even a full-scope ESG value creation assessment. Red flag reports are rapidly becoming the norm in Asia, but the latter two are less common due to on-going challenges such as insufficient data for benchmarking (making it too difficult to correlate to value) or lack of expertise (to effectively analyse the data). There is no “one-size-fits-all” approach to ESG due diligence and should be assessed on each specific transaction, sector, client, etc. as different businesses will present different ESG issues to be considered.

“We are finding that, when presented with an acquisition opportunity, sponsors are asking ‘How does this business make the world a better place?’ Without a convincing answer to potential investors in our marketing materials and due diligence, any sellside process is more at risk, even in Asia.”

Paul DiGiacomo, Managing Partner and Head of Financial Sponsor Coverage, BDA Partners

Aided by such references as Principles for Responsible Investment (“PRI”), Sustainability Accounting Standards Board (“SASB”) and UN’s Sustainable Development Goals (“SDG”), sponsors are encouraging Asian portfolio companies to not only implement action plans to improve ESG performance and reporting, but also ensure that such steps generate robust and quantifiable data to increase accountability. The clear expectation is that being ready to present sustainability KPIs will pave the way for a smoother and more remunerative exit.

One example is the Baring Private Equity Asia (“BPEA”) stewardship of HCP, the Shanghai-headquartered packaging company serving the global cosmetics market. Since its acquisition in 2016, BPEA drove a transformation of HCP’s ESG and sustainability capabilities, including developing refillable packages and use of sustainability-certified manufacturing facilities.This greatly facilitated the onward sale to Carlyle, which was announced in May and should close in Q32022.

“ESG considerations are being tracked and monitored by management and shareholders, and are quickly becoming an important value creation strategy in Asia, including for building brand equity.”

Mark Webster, Partner and Head of Services, BDA Partners

Who is doing what: selected PE Sponsors’ ESG moves in Asia

- Baring Private Equity Asia, the regional PE powerhouse that set up a US$3.2bn ESG loan for APAC investment in 2021 – and has pioneered the implementation of ESG measures across its portfolio including HCP, sale to Carlyle announced (May 2022)

- Goldman Sachs’ portfolio company LRQA acquired Hong Kong-headquartered ELEVATE, the supply chain verification and worker engagement platform (from EQT – May 2022*)

- Navis capitalised on the circular economy thematic, exiting Singapore HQ TES, the electronic waste recycler and IT Asset Disposition service provider, to SK ecoplant of Korea (April 2022*)

- Serendipity Capital’s portfolio company Pollination, the climate change advisory and alternative investment platform, attracted US$50m in Series B capital from ANZ (January 2022*)

- StonePeak leading infrastructure specialist that targets assets globally, including dedicated capital for Asia, announced industry-leading ESG commitments alongside measurable and reportable plans to achieve them, including rigourous sustainability targets and the introduction of related performance incentives (March 2022)

- Temasek and BlackRock created Decarbonization Partners, a US$600m partnership focusing on late-stage venture capital and early-stage growth funds for decarbonisation in 2021. In June 2022, Temasek announced the launch of GenZero, a green investment firm with an initial $5b pledge, a testimony of its commitment to halve the net carbon emissions of its portfolio by 2030 using 2010 as a base and achieve net zero by 2050.

* BDA transaction

[1] Bain Asia-Pacific Private Equity Report 2022

[2] Ibid

[3] www.mckinsey.com/business-functions/sustainability/our-insights/the-esg-premium-new-perspectives-on-value-and-performance, February 2020.

About BDA Partners

BDA Partners is the global investment banking advisor for Asia. We are a premium provider of Asia-related advice to sophisticated clients globally, with over 25 years’ experience advising on cross-border M&A, capital raising, and financial restructuring. We provide global reach with our teams in New York and London, and true regional depth through our seven Asian offices in Mumbai, Singapore, Ho Chi Minh City, Hong Kong, Shanghai, Seoul, and Tokyo. BDA has deep expertise in the Chemicals, Consumer & Retail, Health, Industrials, Services and Technology sectors. We work relentlessly to earn our clients’ trust by delivering insightful advice and outstanding outcomes.

BDA Partners has strategic partnerships with William Blair, a premier global investment banking business, and with DBJ (Development Bank of Japan), a Japanese Government-owned bank with US$150bn of assets. bdapartners.com

BDA Partners hosted our inaugural China Growth Capital Conference on April 26th – 28th. 20 presenting companies from consumer, health, services and technology sectors gave presentations to growth capital investors in over 200 virtual one-on-one meetings.

Anthony Siu, Partner and Co-Head of Shanghai, said: “Our 3-day virtual conference was a big success. It was BDA’s first growth capital conference and it attracted over 300 investors from 150 PE firms to participate in our conference. The attendees included blue-chip global and China USD funds as well as China RMB funds. We also received strong support from Founders and CEOs of high-growth companies in China to present at our conference. These companies represent industries which are at the forefront of China’s economic development including digital health, in-vitro diagnostics, premium healthcare services, lifestyle & wellness and fintech. The strong turnout reflects investor appetite for high-quality companies set to benefit from China’s rapid transformation toward an advanced economy. It also demonstrates ample private market liquidity seeking mid to late stage opportunities in China. We are very pleased to be the partner of choice for our clients in bringing private capital and exciting growth opportunities together.”

We look forward to our next BDA China Growth Capital Conference in 2023, and also the annual BDA PE Conference in late 2022. Please contact us at gcc@bdapartners.com or pe-conference@bdapartners.com if you would like to learn more about either conference, and the benefits of both presenting and attending.

About BDA Partners

BDA Partners is the global investment banking advisor for Asia. We are a premium provider of Asia-related advice to sophisticated clients globally, with over 25 years’ experience advising on cross-border M&A, capital raising, and financial restructuring. We provide global reach with our teams in New York and London, and true regional depth through our seven Asian offices in Mumbai, Singapore, Ho Chi Minh City, Hong Kong, Shanghai, Seoul, and Tokyo. BDA has deep expertise in the Chemicals, Consumer & Retail, Health, Industrials, Services and Technology sectors. We work relentlessly to earn our clients’ trust by delivering insightful advice and outstanding outcomes.

BDA Partners has strategic partnerships with William Blair, a premier global investment banking business, and with DBJ (Development Bank of Japan), a Japanese Government-owned bank with US$150bn of assets. bdapartners.com