2023/11/16

Cooling-as-a-Service: Decarbonisation by Servitisation

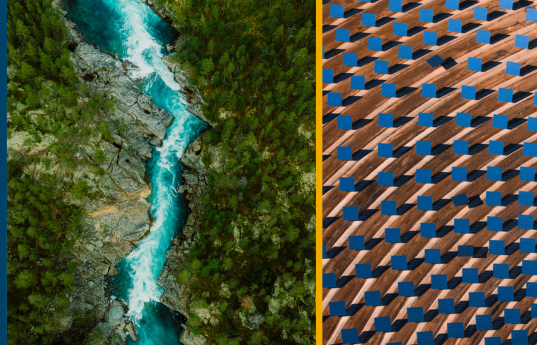

One of the most promising shifts for decarbonisation is the introduction of “Cooling-as-a-Service” or “CaaS”. With temperatures rising globally, temperature cooling has never been as important but comes with a significant environmental footprint. Outsourcing cooling to a third party directly incentivises these service providers to provide service as efficiently and environmentally friendly as possible and design a better, less carbon-intensive cooling infrastructure.

- The carbon footprint of the “built environment” already represents ~26% of global CO2 emissions and will continue to become more significant without fundamental change

- The CaaS model allows the service provider to assume full responsibility for the design and investment ownership required for the cooling installation and related equipment, associated energy and water consumption, and it’s operation, maintenance and optimisation

- The service provider is accountable for achieving specific metrics while charging at a fixed price

- The client is only responsible for ensuring a consistent supply of electricity and water to the equipment

- The CaaS provider is therefore directly incentivised to install and/or run the equipment in the most efficient way possible

Download the full report for more insight regarding CaaS and its potential impact on decarbonisation

Sources: United Nations, Global Change Data Lab, IEA, The Economist

About BDA Partners

BDA Partners is the global investment banking advisor for Asia. We are a premium provider of Asia-related advice to sophisticated clients globally, with over 25 years’ experience advising on cross-border M&A, capital raising, and financial restructuring. We provide global reach with our teams in New York and London, and true regional depth through our seven Asian offices in Mumbai, Singapore, Ho Chi Minh City, Hong Kong, Shanghai, Seoul, and Tokyo. BDA has deep expertise in the Chemicals, Consumer & Retail, Health, Industrials, Services, Sustainability and Technology sectors. We work relentlessly to earn our clients’ trust by delivering insightful advice and outstanding outcomes.

BDA Partners has strategic partnerships with William Blair, a premier global investment banking business, and with DBJ (Development Bank of Japan), a Japanese Government-owned bank with US$150bn of assets. bdapartners.com

Latest insights

2025/01/21

Environmental services and waste management – expert interview with Howard...

BDA Partners advised IMM’s consortium on their successful US$1.6 billion...

2025/01/10

Japan’s $230bn M&A boom will get even bigger: Jeff Acton quoted in...

Jeff Acton, Co-Head of Tokyo, BDA Partners, was quoted by Bloomberg. He...

2024/12/18

“Asia private equity 2025 preview: exits and liquidity”; Euan Rellie...

BDA Managing Partner Euan Rellie spoke with MergerMarket about the year...

2024/12/12

BDA’s Simon Kavanagh speaks to Bloomberg about Hong Kong’s...

Simon Kavanagh, Head of Industrials, BDA, was quoted in Bloomberg. Bloomberg...