2022/07/08

Trends in Asian ESG PE investment

There has been a distinct focus on ESG and sustainability in Asian private equity deal activity in the first half of 2022, with implications for new investments, portfolio management and exits. We have seen this trend accelerate as we advise on a series of such transactions this year.

Asian sponsors are evaluating deals through an ESG lens

Western sponsors have thus far largely led the way on ESG considerations in M&A, with their APAC counterparts lagging behind. According to a recent Bain[1] survey, only 65% of APAC sponsors expect their LPs to scrutinise ESG issues over the next three years, compared to 96% and 80% for North America and Europe respectively.

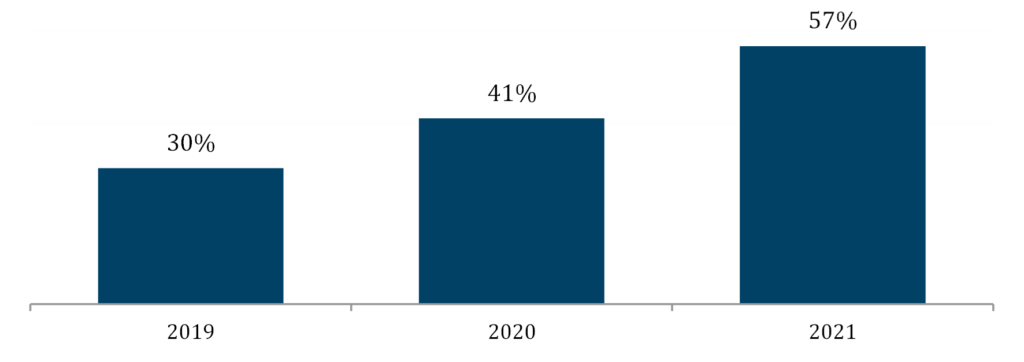

However, the ESG agenda in Asian business is now picking up significant momentum. The survey[2] also found 57% of Asian GPs plan to materially increase their ESG efforts over the next three to five years, up from 30% in 2019. This goes beyond just compliance and regulatory reporting, with more and more funds adopting an explicit – and exclusive – focus on new investments that will have both a positive impact and generate higher financial returns.

These twin goals are no longer seen as contradictory, rather, self-reinforcing. In a McKinsey Global Survey[3], C-suite leaders indicated they would be prepared to pay a 10% premium to acquire a company with a positive ESG track record versus a company without one. Furthermore, the consensus was that ESG programmes created value over the short and long term.

PE funds are proactively issuing ESG/sustainability related reports (i.e. EQT, Partners Group, Carlyle, and Permira, all with a major presence in Asia) which have started to disclose ESG measurements at the fund and portfolio company level, including scope 1 and 2 carbon emissions, energy consumption, diversity and inclusion metrics, corruption, etc. Those that have set up an ESG reporting framework and roadmap for each portfolio company across the investment lifecycle will be better placed for a successful exit.

Asian GPs: increasing their focus on ESG / Sustainability

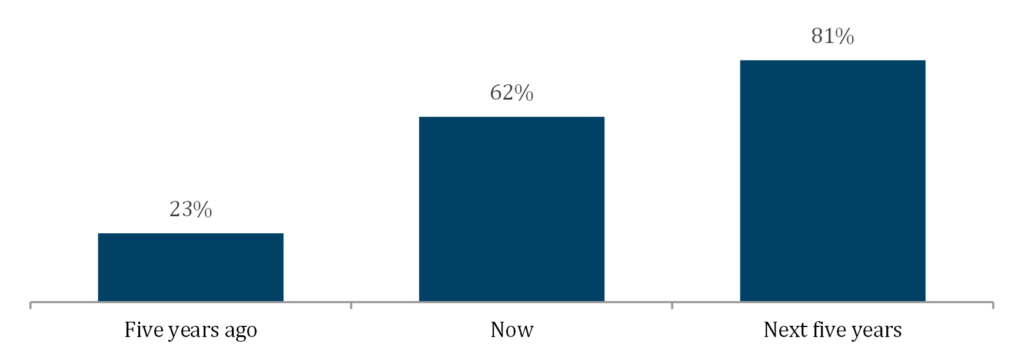

Asian GPs: % of assets evaluated with ESG due diligence

Source: Bain Asia-Pacific Private Equity Report 2022

Deal types

Robust and high ESG standard gives an investment opportunity a competitive edge, without which will greatly hinder financial sponsors’ deal appetite, whether deploying dedicated “impact-labelled” funds or generalist capital. We have witnessed exceptional demand for ESG-oriented business models in 2022 such as: validation of supply chains and workforce conditions, responsible electronic waste recycling and a range of renewable energy plays. Conversely, the manufacturing of consumer items that lack a sustainability narrative find it harder to navigate the investment committee stage. Investment committees are also putting greater focus on ESG at the M&A decision making stage and more are avoiding certain end markets with a high carbon intensity.

“BDA is building a solid track record in sustainable infrastructure and services in Asia, and globally for Asian clients.”

Lars Freitag, Managing Director and Head of Sustainability: Services & Infrastructure, BDA Partners

Renewable Energy

E-waste Recycling & IT Asset Disposition

ESG & Supply Chain Services

Exit implications for PEs

ESG is now front and centre in both M&A due diligence and the value creation playbook.

For M&A due diligence, the role ESG plays can vary from a simple red flag checklist to a dedicated ESG vendor due diligence report (with comparisons to market competitors, emissions calculations etc.) or even a full-scope ESG value creation assessment. Red flag reports are rapidly becoming the norm in Asia, but the latter two are less common due to on-going challenges such as insufficient data for benchmarking (making it too difficult to correlate to value) or lack of expertise (to effectively analyse the data). There is no “one-size-fits-all” approach to ESG due diligence and should be assessed on each specific transaction, sector, client, etc. as different businesses will present different ESG issues to be considered.

“We are finding that, when presented with an acquisition opportunity, sponsors are asking ‘How does this business make the world a better place?’ Without a convincing answer to potential investors in our marketing materials and due diligence, any sellside process is more at risk, even in Asia.”

Paul DiGiacomo, Managing Partner and Head of Financial Sponsor Coverage, BDA Partners

Aided by such references as Principles for Responsible Investment (“PRI”), Sustainability Accounting Standards Board (“SASB”) and UN’s Sustainable Development Goals (“SDG”), sponsors are encouraging Asian portfolio companies to not only implement action plans to improve ESG performance and reporting, but also ensure that such steps generate robust and quantifiable data to increase accountability. The clear expectation is that being ready to present sustainability KPIs will pave the way for a smoother and more remunerative exit.

One example is the Baring Private Equity Asia (“BPEA”) stewardship of HCP, the Shanghai-headquartered packaging company serving the global cosmetics market. Since its acquisition in 2016, BPEA drove a transformation of HCP’s ESG and sustainability capabilities, including developing refillable packages and use of sustainability-certified manufacturing facilities.This greatly facilitated the onward sale to Carlyle, which was announced in May and should close in Q32022.

“ESG considerations are being tracked and monitored by management and shareholders, and are quickly becoming an important value creation strategy in Asia, including for building brand equity.”

Mark Webster, Partner and Head of Services, BDA Partners

Who is doing what: selected PE Sponsors’ ESG moves in Asia

- Baring Private Equity Asia, the regional PE powerhouse that set up a US$3.2bn ESG loan for APAC investment in 2021 – and has pioneered the implementation of ESG measures across its portfolio including HCP, sale to Carlyle announced (May 2022)

- Goldman Sachs’ portfolio company LRQA acquired Hong Kong-headquartered ELEVATE, the supply chain verification and worker engagement platform (from EQT – May 2022*)

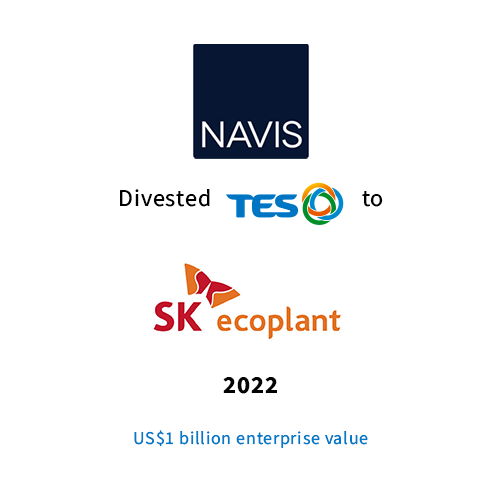

- Navis capitalised on the circular economy thematic, exiting Singapore HQ TES, the electronic waste recycler and IT Asset Disposition service provider, to SK ecoplant of Korea (April 2022*)

- Serendipity Capital’s portfolio company Pollination, the climate change advisory and alternative investment platform, attracted US$50m in Series B capital from ANZ (January 2022*)

- StonePeak leading infrastructure specialist that targets assets globally, including dedicated capital for Asia, announced industry-leading ESG commitments alongside measurable and reportable plans to achieve them, including rigourous sustainability targets and the introduction of related performance incentives (March 2022)

- Temasek and BlackRock created Decarbonization Partners, a US$600m partnership focusing on late-stage venture capital and early-stage growth funds for decarbonisation in 2021. In June 2022, Temasek announced the launch of GenZero, a green investment firm with an initial $5b pledge, a testimony of its commitment to halve the net carbon emissions of its portfolio by 2030 using 2010 as a base and achieve net zero by 2050.

* BDA transaction

[1] Bain Asia-Pacific Private Equity Report 2022

[2] Ibid

[3] www.mckinsey.com/business-functions/sustainability/our-insights/the-esg-premium-new-perspectives-on-value-and-performance, February 2020.

About BDA Partners

BDA Partners is the global investment banking advisor for Asia. We are a premium provider of Asia-related advice to sophisticated clients globally, with over 25 years’ experience advising on cross-border M&A, capital raising, and financial restructuring. We provide global reach with our teams in New York and London, and true regional depth through our seven Asian offices in Mumbai, Singapore, Ho Chi Minh City, Hong Kong, Shanghai, Seoul, and Tokyo. BDA has deep expertise in the Chemicals, Consumer & Retail, Health, Industrials, Services and Technology sectors. We work relentlessly to earn our clients’ trust by delivering insightful advice and outstanding outcomes.

BDA Partners has strategic partnerships with William Blair, a premier global investment banking business, and with DBJ (Development Bank of Japan), a Japanese Government-owned bank with US$150bn of assets. bdapartners.com

Latest insights

2025/01/21

Environmental services and waste management – expert interview with Howard...

BDA Partners advised IMM’s consortium on their successful US$1.6 billion...

2025/01/10

Japan’s $230bn M&A boom will get even bigger: Jeff Acton quoted in...

Jeff Acton, Co-Head of Tokyo, BDA Partners, was quoted by Bloomberg. He...

2024/12/18

“Asia private equity 2025 preview: exits and liquidity”; Euan Rellie...

BDA Managing Partner Euan Rellie spoke with MergerMarket about the year...

2024/12/12

BDA’s Simon Kavanagh speaks to Bloomberg about Hong Kong’s...

Simon Kavanagh, Head of Industrials, BDA, was quoted in Bloomberg. Bloomberg...