2025/04/09

Wind thought piece – Onshore tailwinds

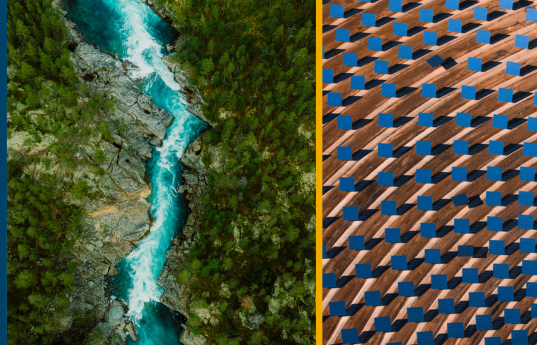

The global wind industry is entering a new era of growth. The need to triple annual installation by 2030 net-zero goals and minimize divergence from a global 1.5 C temperature increase, remains. In this piece, we represent BDA’s insight into the following:

- Onshore wind’s relative cost – or levelized cost of energy (LCOE) – dropped by 70% from 2010 to 2023. Onshore wind is now the most competitive global energy solution ahead of solar, hydro, and fossil fuel base-load solutions

- Whilst onshore and offshore wind have structural similarities, these differ materially in delivery – given complexities such as size, logistics, supply chain, installation and energy grid connectivity

- The wind industry continues on its long-term historical double digit annual growth journey, with onshore wind expected to grow 10% per annum and offshore wind at 22% (2024-2030)

- A large portion of the broader wind supply chain sits in China, with Western OEMs manufacturing in the country only to fulfil export / non-Chinese wind turbine demand. Geopolitical tensions are now resulting in increased geographical diversification – with India deemed a winner

- Rare Earth Permanent Magnets, made of those scarce elements often used in the e-Mobility industry, may soon blow by as a thing of the past in wind turbines – with new technologies potentially reducing the industry need to 1/10th, given the complete obsolescence of gearboxes in direct drive turbines

- We also exclusively interview the Global Wind Energy Council, a leading representative body for the wind industry with over 1,500 member companies, for their independent expert views

Please feel free to contact any of the BDA contacts below.

Download the full report here.

About BDA Partners

BDA Partners is the global investment banking advisor for Asia. We are a premium provider of Asia-related advice to sophisticated clients globally, with 30 years’ experience advising on cross-border M&A, capital raising, and financial restructuring. We provide global reach with our teams in New York and London, and true regional depth through our seven Asian offices in Mumbai, Singapore, Ho Chi Minh City, Hong Kong, Shanghai, Seoul and Tokyo. BDA has deep expertise in the Chemicals, Consumer & Retail, Health, Industrials, Services, Sustainability and Technology sectors. We work relentlessly to earn our clients’ trust by delivering insightful advice and outstanding outcomes.

BDA Partners has strategic partnerships with William Blair, a premier global investment banking business, and with DBJ (Development Bank of Japan), a Japanese Government-owned bank with US$150bn of assets.

US securities transactions are performed by BDA Partners’ affiliate, BDA Advisors Inc, a broker-dealer registered with the Securities and Exchange Commission (SEC). BDA Advisors Inc is a member of the Financial Industry Regulatory Authority (FINRA) and SIPC. In the UK, BDA Partners is authorized and regulated by the Financial Conduct Authority (FCA). In Hong Kong, BDA Partners (HK) Ltd is licensed and regulated by the Securities & Futures Commission (SFC) to conduct Type 1 and Type 4 regulated activities to professional investors. www.bdapartners.com

Latest insights

2025/04/17

Southeast Asia Healthcare Distribution: Delivering value

We assessed both the medical devices (Medtech) and […]

2025/01/21

Environmental services and waste management – expert interview with Howard...

BDA Partners advised IMM’s consortium on their successf […]

2025/01/10

Japan’s $230bn M&A boom will get even bigger: Jeff Acton quoted in...

Jeff Acton, Co-Head of Tokyo, BDA Partners, was quoted […]

2024/12/18

“Asia private equity 2025 preview: exits and liquidity”; Euan Rellie...

BDA Managing Partner Euan Rellie spoke with MergerMarke […]