Corporate divestments, PE investments and activist campaigns: a virtuous circle for Japan

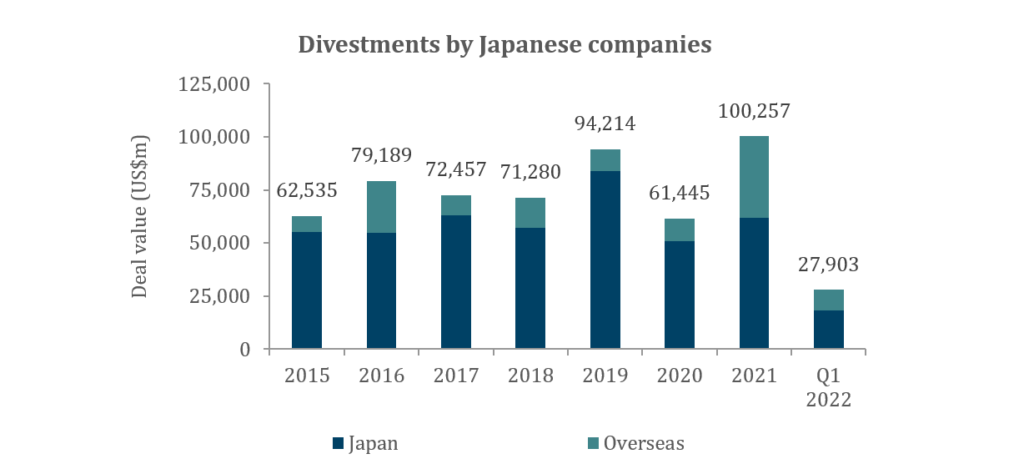

In the last few years, several trends have gained traction in Japan’s M&A market. The trends had already begun to take hold before COVID, which did not slow their development. In our latest insight, we take a closer look at three of the most significant trends, which are interrelated and are driving one another: 1) divestments by Japanese companies; 2) the ever-increasing activity of PE funds; and 3) the growing influence of activist funds.

Key takeaways:

Japanese companies are increasingly willing to divest non-core subsidiaries and assets, driven by changing perceptions about corporate divestments

- This has been led by large-cap companies so far, but smaller companies are expected to join as they also begin to appreciate the benefits

Divestments by Japanese companies are proving to be fruitful targets for PE funds, who are aggressively entering Japan market and raising record levels of capital

- Many corporate carveouts in Japan over the last few years have seen PE funds emerge as the successful acquirer

Another set of investment funds, activist investors, have stepped up their activity in Japan, embarking on campaigns against large companies to pressure them to increase corporate value

- A common demand of activist campaigns is the divestment of non-core assets, which feeds into the first trend, thus continuing the cycle

Source: Dealogic

Download the full report

Download the full report in Japanese

About BDA Partners

BDA Partners is the global investment banking advisor for Asia. We are a premium provider of Asia-related advice to sophisticated clients globally, with over 25 years’ experience advising on cross-border M&A, capital raising, and financial restructuring. We provide global reach with our teams in New York and London, and true regional depth through our seven Asian offices in Mumbai, Singapore, Ho Chi Minh City, Hong Kong, Shanghai, Seoul, and Tokyo. BDA has deep expertise in the Chemicals, Consumer & Retail, Health, Industrials, Services and Technology sectors. We work relentlessly to earn our clients’ trust by delivering insightful advice and outstanding outcomes.

BDA Partners has strategic partnerships with William Blair, a premier global investment banking business, and with DBJ (Development Bank of Japan), a Japanese Government-owned bank with US$150bn of assets. bdapartners.com

There has been a distinct focus on ESG and sustainability in Asian private equity deal activity in the first half of 2022, with implications for new investments, portfolio management and exits. We have seen this trend accelerate as we advise on a series of such transactions this year.

Asian sponsors are evaluating deals through an ESG lens

Western sponsors have thus far largely led the way on ESG considerations in M&A, with their APAC counterparts lagging behind. According to a recent Bain[1] survey, only 65% of APAC sponsors expect their LPs to scrutinise ESG issues over the next three years, compared to 96% and 80% for North America and Europe respectively.

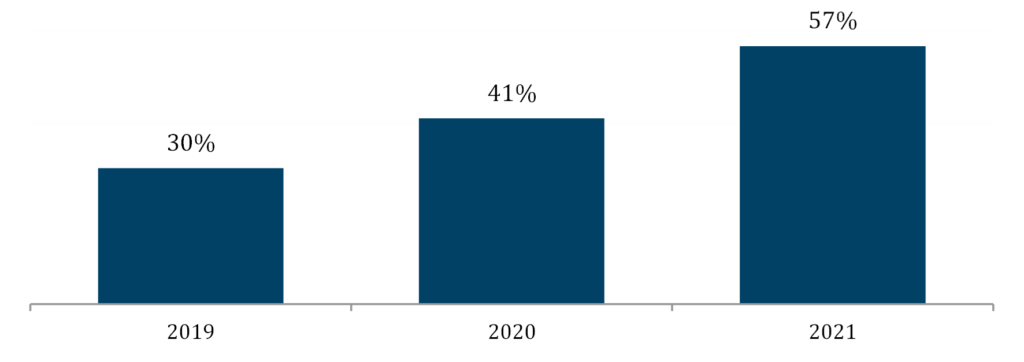

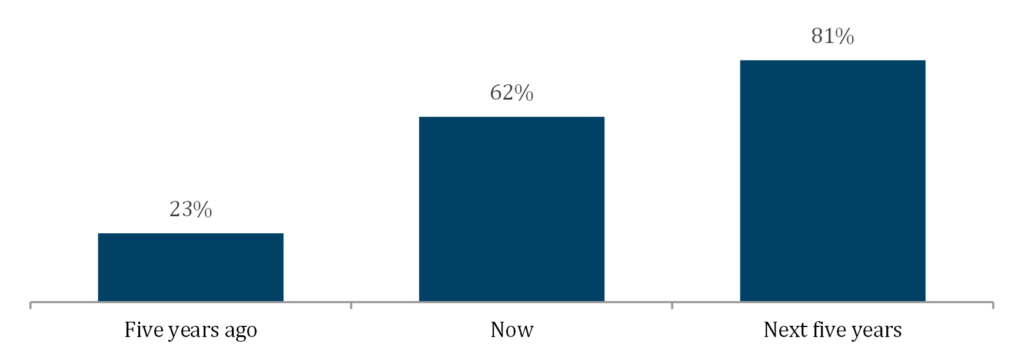

However, the ESG agenda in Asian business is now picking up significant momentum. The survey[2] also found 57% of Asian GPs plan to materially increase their ESG efforts over the next three to five years, up from 30% in 2019. This goes beyond just compliance and regulatory reporting, with more and more funds adopting an explicit – and exclusive – focus on new investments that will have both a positive impact and generate higher financial returns.

These twin goals are no longer seen as contradictory, rather, self-reinforcing. In a McKinsey Global Survey[3], C-suite leaders indicated they would be prepared to pay a 10% premium to acquire a company with a positive ESG track record versus a company without one. Furthermore, the consensus was that ESG programmes created value over the short and long term.

PE funds are proactively issuing ESG/sustainability related reports (i.e. EQT, Partners Group, Carlyle, and Permira, all with a major presence in Asia) which have started to disclose ESG measurements at the fund and portfolio company level, including scope 1 and 2 carbon emissions, energy consumption, diversity and inclusion metrics, corruption, etc. Those that have set up an ESG reporting framework and roadmap for each portfolio company across the investment lifecycle will be better placed for a successful exit.

Asian GPs: increasing their focus on ESG / Sustainability

Asian GPs: % of assets evaluated with ESG due diligence

Source: Bain Asia-Pacific Private Equity Report 2022

Deal types

Robust and high ESG standard gives an investment opportunity a competitive edge, without which will greatly hinder financial sponsors’ deal appetite, whether deploying dedicated “impact-labelled” funds or generalist capital. We have witnessed exceptional demand for ESG-oriented business models in 2022 such as: validation of supply chains and workforce conditions, responsible electronic waste recycling and a range of renewable energy plays. Conversely, the manufacturing of consumer items that lack a sustainability narrative find it harder to navigate the investment committee stage. Investment committees are also putting greater focus on ESG at the M&A decision making stage and more are avoiding certain end markets with a high carbon intensity.

“BDA is building a solid track record in sustainable infrastructure and services in Asia, and globally for Asian clients.”

Lars Freitag, Managing Director and Head of Sustainability: Services & Infrastructure, BDA Partners

Renewable Energy

E-waste Recycling & IT Asset Disposition

ESG & Supply Chain Services

Exit implications for PEs

ESG is now front and centre in both M&A due diligence and the value creation playbook.

For M&A due diligence, the role ESG plays can vary from a simple red flag checklist to a dedicated ESG vendor due diligence report (with comparisons to market competitors, emissions calculations etc.) or even a full-scope ESG value creation assessment. Red flag reports are rapidly becoming the norm in Asia, but the latter two are less common due to on-going challenges such as insufficient data for benchmarking (making it too difficult to correlate to value) or lack of expertise (to effectively analyse the data). There is no “one-size-fits-all” approach to ESG due diligence and should be assessed on each specific transaction, sector, client, etc. as different businesses will present different ESG issues to be considered.

“We are finding that, when presented with an acquisition opportunity, sponsors are asking ‘How does this business make the world a better place?’ Without a convincing answer to potential investors in our marketing materials and due diligence, any sellside process is more at risk, even in Asia.”

Paul DiGiacomo, Managing Partner and Head of Financial Sponsor Coverage, BDA Partners

Aided by such references as Principles for Responsible Investment (“PRI”), Sustainability Accounting Standards Board (“SASB”) and UN’s Sustainable Development Goals (“SDG”), sponsors are encouraging Asian portfolio companies to not only implement action plans to improve ESG performance and reporting, but also ensure that such steps generate robust and quantifiable data to increase accountability. The clear expectation is that being ready to present sustainability KPIs will pave the way for a smoother and more remunerative exit.

One example is the Baring Private Equity Asia (“BPEA”) stewardship of HCP, the Shanghai-headquartered packaging company serving the global cosmetics market. Since its acquisition in 2016, BPEA drove a transformation of HCP’s ESG and sustainability capabilities, including developing refillable packages and use of sustainability-certified manufacturing facilities.This greatly facilitated the onward sale to Carlyle, which was announced in May and should close in Q32022.

“ESG considerations are being tracked and monitored by management and shareholders, and are quickly becoming an important value creation strategy in Asia, including for building brand equity.”

Mark Webster, Partner and Head of Services, BDA Partners

Who is doing what: selected PE Sponsors’ ESG moves in Asia

- Baring Private Equity Asia, the regional PE powerhouse that set up a US$3.2bn ESG loan for APAC investment in 2021 – and has pioneered the implementation of ESG measures across its portfolio including HCP, sale to Carlyle announced (May 2022)

- Goldman Sachs’ portfolio company LRQA acquired Hong Kong-headquartered ELEVATE, the supply chain verification and worker engagement platform (from EQT – May 2022*)

- Navis capitalised on the circular economy thematic, exiting Singapore HQ TES, the electronic waste recycler and IT Asset Disposition service provider, to SK ecoplant of Korea (April 2022*)

- Serendipity Capital’s portfolio company Pollination, the climate change advisory and alternative investment platform, attracted US$50m in Series B capital from ANZ (January 2022*)

- StonePeak leading infrastructure specialist that targets assets globally, including dedicated capital for Asia, announced industry-leading ESG commitments alongside measurable and reportable plans to achieve them, including rigourous sustainability targets and the introduction of related performance incentives (March 2022)

- Temasek and BlackRock created Decarbonization Partners, a US$600m partnership focusing on late-stage venture capital and early-stage growth funds for decarbonisation in 2021. In June 2022, Temasek announced the launch of GenZero, a green investment firm with an initial $5b pledge, a testimony of its commitment to halve the net carbon emissions of its portfolio by 2030 using 2010 as a base and achieve net zero by 2050.

* BDA transaction

[1] Bain Asia-Pacific Private Equity Report 2022

[2] Ibid

[3] www.mckinsey.com/business-functions/sustainability/our-insights/the-esg-premium-new-perspectives-on-value-and-performance, February 2020.

About BDA Partners

BDA Partners is the global investment banking advisor for Asia. We are a premium provider of Asia-related advice to sophisticated clients globally, with over 25 years’ experience advising on cross-border M&A, capital raising, and financial restructuring. We provide global reach with our teams in New York and London, and true regional depth through our seven Asian offices in Mumbai, Singapore, Ho Chi Minh City, Hong Kong, Shanghai, Seoul, and Tokyo. BDA has deep expertise in the Chemicals, Consumer & Retail, Health, Industrials, Services and Technology sectors. We work relentlessly to earn our clients’ trust by delivering insightful advice and outstanding outcomes.

BDA Partners has strategic partnerships with William Blair, a premier global investment banking business, and with DBJ (Development Bank of Japan), a Japanese Government-owned bank with US$150bn of assets. bdapartners.com

Since 2020 BDA has successfully advised on nearly 60 transactions, making us one of the most active M&A advisors in Asia. This level of experience underpins our ability to deliver successful outcomes for our clients under dynamic market conditions.

For over 20 years, our Hong Kong team has advised multinationals on strategic carve-outs and bolt-ons, guided entrepreneurs on divestments and capital raises, and supported financial sponsors on investments and portfolio company exits.

We continue to leverage this experience and insight to deliver value-optimising results for our clients who entrust us with their business.

The enclosed flyer provides a snapshot of our capabilities and our recent track record globally and in the Greater China region. Our experienced and dedicated team of Hong Kong-based bankers is ready to support your M&A ambitions. Should you wish to learn more about BDA, our expertise and how we can assist you, please reach out to one of our contacts below:

- Paul DiGiacomo, Managing Partner: pdigiacomo@bdapartners.com

- Simon Kavanagh, Partner: skavanagh@bdapartners.com

- Karen Cheung, Managing Director: kcheung@bdapartners.com

- Mireille Chan, Director: mchan@bdapartners.com

- Jakub Widzyk, Director: jwidzyk@bdapartners.com

About BDA Partners

BDA Partners is the global investment banking advisor for Asia. We are a premium provider of Asia-related advice to sophisticated clients globally, with over 25 years’ experience advising on cross-border M&A, capital raising, and financial restructuring. We provide global reach with our teams in New York and London, and true regional depth through our seven Asian offices in Mumbai, Singapore, Ho Chi Minh City, Hong Kong, Shanghai, Seoul, and Tokyo. BDA has deep expertise in the Chemicals, Consumer & Retail, Health, Industrials, Services and Technology sectors. We work relentlessly to earn our clients’ trust by delivering insightful advice and outstanding outcomes.

BDA Partners has strategic partnerships with William Blair, a premier global investment banking business, and with DBJ (Development Bank of Japan), a Japanese Government-owned bank with US$150bn of assets. bdapartners.com

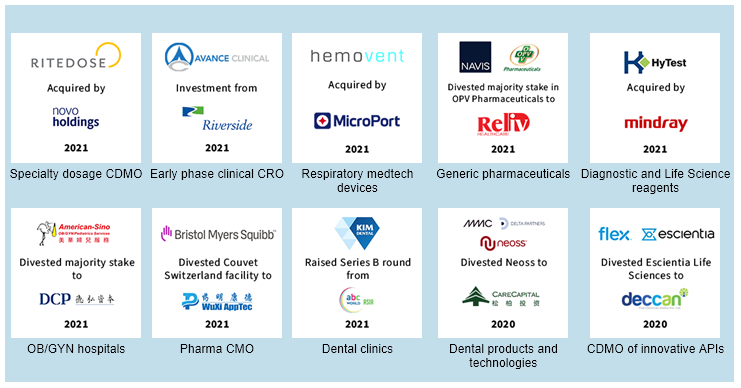

2021 was a phenomenal year for deal activity in the Healthcare sector. Strong M&A momentum continued across most Healthcare verticals despite, and sometimes because of, extended COVID-19 disruptions. BDA closed landmark transactions across sub-sectors including Pharma Services (CRO/CDMO), Specialty Generics, Healthcare Services, Diagnostics and Life Science Tools, and Medical Devices, which touched on specialty therapeutic areas such as respiratory, renal care, OB/GYN and dental.

It was a busy year for Asian players in healthcare. Among them, Chinese buyers emerged as some of the most active participants, driven by the desire to expand their capabilities to address unmet needs in the strongly growing Chinese market. With our deep sector knowledge and broad network, BDA delivered strong transaction outcomes for our corporate and private equity clients throughout the pandemic.

Enabling client success:

BDA’s senior Healthcare bankers give their predictions for the year ahead.

Andrew Huntley, Managing Partner and Global Head of Healthcare:

In 2022 I believe the 2021 Asian Healthcare M&A tally of US$139.6 billion(1) will grow further. COVID-19 impacts that disguised underlying EBITDA and created valuation and diligence frictions between buyer and seller should moderate. Specialty clinic chains, pharma services (CRO and CDMO), and diagnostic products and services will continue to attract M&A in Asia. Life science tools and technologies is a category for which I see a growing appetite where the region lags developed markets. So is home healthcare. I am waiting for an Asian leader in medical device CDMO to emerge and there are some interesting building blocks out there. Consolidation trends in China will play out; and we might see some multinational divestments of Chinese units in pharma and devices.

Sanjay Singh, Managing Director, Head of India and Co-Head Asia, Healthcare:

India continues to build innovative pharma research and development capabilities on top of its generics base. This is especially the case in pharma services where I see increasingly well positioned CDMO assets in both API (drug substance) and formulations (drug product) which serve global pharma sponsors not just generics customers. These will drive capital raising and M&A transactions, as will early signs of India nurturing some differentiated medical device innovators. Domestic formulation businesses will likely see consolidation as larger companies seek to expand their presence in chronic therapies. Digital health and Healthcare IT are, respectively, new and established exciting segments for investment and M&A.

Anthony Siu, Partner, Co-Head of Shanghai and Head of Financial Sponsor Coverage, China:

Private equity owners of Health assets are going to capitalise on the favourable sector trends to exit their investments, but they will also be very active acquirers, armed with ample dry powder of over US$650 billion Asia-wide. Healthcare regularly features in the top two priority sectors for Asian financial sponsors. China focused sponsors will continue to back or partner with strategic acquirers to drive both consolidation within China and outbound acquisitions in the West. On the capital markets side, growing uncertainties in public markets will increase the appeal of private capital raise rounds before IPO.

We look forward to delivering outstanding advisory services and great outcomes for our clients.

About BDA Partners

BDA Partners is the global investment banking advisor for Asia. We are a premium provider of Asia-related advice to sophisticated clients globally, with over 25 years’ experience advising on cross-border M&A, capital raising, and financial restructuring. We provide global reach with our teams in New York and London, and true regional depth through our seven Asian offices in Mumbai, Singapore, Ho Chi Minh City, Hong Kong, Shanghai, Seoul, and Tokyo. BDA has deep expertise in the Chemicals, Consumer & Retail, Health, Industrials, Services and Technology sectors. We work relentlessly to earn our clients’ trust by delivering insightful advice and outstanding outcomes.

BDA Partners has strategic partnerships with William Blair, a premier global investment banking business, and with DBJ (Development Bank of Japan), a Japanese Government-owned bank with US$150bn of assets. bdapartners.com

The article was originally published in the September 2021 issue of Vietnam Economic Times

Huong Trinh

Managing Director, Head of Ho Chi Minh, BDA Partners

Despite Vietnam experiencing its fourth wave of Covid-19, merger and acquisition (M&A) activities will continue to remain strong. Since the beginning of this year, we at BDA Ho Chi Minh City have seen strong interest from large regional PEs (private equity firms) looking for sizable transactions. We are also observing strong demand for growth capital and exits from both founder-backed and private equity-owned companies, evidenced by numerous current live deals and strong pipelines/opportunities for 2021.

Vietnam’s macroeconomic fundamentals remain strong. In the International Monetary Fund (IMF)’s revised forecast released in July, the country is still on track to remain the fastest-growing economy in Southeast Asia this year, with projected growth of 6.5 percent. Vietnam also has one of the fastest-growing middle-class populations, with rising discretionary spending power, leading to high pent-up demand for goods and services that will contribute to economic recovery as the country opens up again later this year.

Key industries predicted to grow strongly

In general, Vietnam’s economy has remained resilient and maintained good momentum for growth across industries despite the recent surge of Covid-19. In addition to consumer and retail which has always been one of the most active sectors in Vietnam and is expected to rebound strongly in 2022 thanks to the recovery of consumer confidence, the following sectors have been attracting a lot of interest.

We believe that IT & Technology and especially the internet-related segment will achieve the strongest growth in Vietnam, and that there will be a strong pipeline of opportunities for the sector in 2021 and upcoming years. Difficulties caused by the pandemic have driven growth in demand across all industries for technology-related services and digital solutions that help businesses function normally. In a post-pandemic world, there will be a continued push for swift digitalization, and M&As will be the fastest way for businesses to achieve this goal. Also, Vietnam’s internet economy has been growing rapidly during Covid-19, and we expect this trend to continue as there have been long-term changes to consumer habits and dynamics. The pandemic, for all its negative impacts on health, society, and economy, is propelling the growth of e-commerce and digital finance in Vietnam, paving the way for the country to fulfill its digital potential. According to the Ministry of Industry and Trade, Vietnam’s e-commerce market grew 18 percent year-on-year in 2020 to $11.8 billion, while traffic on e-commerce platforms was 150 percent higher than in 2019.

Pharmaceuticals is an industry that has attracted a lot of interest from foreign investors in recent years, with notable transactions including Taisho’s acquisition of a majority stake in DHG Pharma and SK’s recent investment in Imexpharm. According to BMI Research, Vietnam’s pharmaceutical industry could reach $7.7 billion in 2021 and $16.1 billion in 2026. A growing middle class, urbanization, and a young population are driving domestic demand for all aspects of healthcare, including expenditures on pharmaceuticals. As a defensive sector, pharmaceuticals will continue to achieve strong growth as Vietnam transitions out of the pandemic period. The industry is set to benefit greatly from the government’s national strategy to promote domestic manufacturing. To compete with imports, M&As with foreign strategic investors will continue to be crucial for local manufacturers, enabling them to meet global pharmaceutical standards through transfers of technology, R&D, and management expertise.

Renewable energy has also become an interesting sector for M&A activity in Vietnam over recent years, and we expect deal flow to resume as the country gradually opens up. With a rapidly growing economy, Vietnam has been at risk of power shortages as demand exceeds supply due to a lack of power infrastructure, and capital injections into the development of renewable energy could provide a good solution. Vietnam became the largest solar energy market in Southeast Asia in 2019, attracting foreign investors in mega plants in Binh Phuoc, Tay Ninh, and Ninh Thuan provinces, given the more attractive feed-in-tariff schemes compared to other countries in the region. Buyers have also been active with acquisitions of onshore and offshore wind farms in the central highlands and central coastal regions, which boast huge potential given their ample wind resources.

In Vietnam’s real estate market, M&A remains the quickest solution for foreign developers to enter the country and for local developers to expand their land portfolio. An increase in real estate M&A activity is expected this year, as various projects will be approved thanks to new improvements in the Law on Investment, after lengthy delays in the review process in previous years. Investors have accumulated a lot of capital, which is waiting to be deployed as the economy recovers, while owners struggling from the impact of the pandemic are willing to sell at lower valuations. Within the sector, industrial real estate has seen more activity in 2021, as multinational companies continue to shift their manufacturing bases from China to Vietnam despite the ongoing pandemic. Meanwhile, deal flow in residential real estate is expected to recover in the latter half of the year, as postponed transactions are resumed when travel restrictions are loosened.

Manufacturing, one of the sectors temporarily hit by Covid-19, will also provide opportunities to buyers who are confident of a strong economic recovery. Vietnam has been emerging as a manufacturing hub in the region given its low labor costs, its strategic location and many seaports nationwide, and its increasing participation in free trade agreements. For these reasons, its manufacturing sector will remain attractive to foreign investors, especially given ongoing China-US trade tensions, resulting in the relocation of manufacturing hubs from China to Vietnam. Domestically, there could also be a pickup in M&A activity, as we might see a trend in the consolidation of struggling small and medium-sized players into respective market leaders. Demand for growth capital from businesses looking for internal transformation and rebuilding post-pandemic will also present opportunities for investors looking for high-quality assets at attractive valuations.

Common risks and opportunities

Some of the common risks include uncertainty in the legal framework, especially new laws that came into effect recently, quality of information, as some companies still do not apply best practices in bookkeeping, an unfamiliarity among Vietnamese sellers with M&As and the basic concepts and processes involved, and cultural differences during deal negotiation and post-deal integration.

M&A transactions in Vietnam are largely governed by the Law on Enterprises, the Law on Investment, and the Law on Competition. Recent changes in these laws have posed additional challenges to potential buyers. For example, under the new Law on Competition, a substantially higher percentage of M&A deals are subject to merger control filing requirements, and the evaluation process could potentially add months of uncertainty to the timeline of a deal. Quality of information is also a common issue for foreign buyers, as target companies do not always have an organized information system that meets their requirements.

The current postponement of inbound international flights due to the pandemic also makes it difficult for buyers to conduct in-depth due diligence through site visits and face-to-face meetings. Additionally, foreign buyers might be unfamiliar with cultural differences in corporate governance practices in Vietnam. Many target companies are founder-owned, family-run businesses, which may not yet see the value-added of foreign strategic and financial partners or be open to international corporate governance standards. Last but not least, Vietnamese sellers lack knowledge in terms of how the M&A process works and is structured, which will create uncertainties.

Despite the existing drawbacks, it is important to acknowledge that compared to a decade ago, the perception of M&As in Vietnam has changed dramatically among government agencies, business owners, and investors/buyers and in a positive way. Authorities are continuously improving their turn-around times and responsiveness, while working toward new guidelines for M&A transactions, with the new Law on Enterprises, Law on Investment, and Law on Securities having come into effect on January 1, 2021. Shareholders are now more open to adding M&A as a strategic option in their growth trajectory and are becoming more educated in terms of M&A processes and key concepts. We see that sellers are taking a much more structured approach for large domestic deals or cross-border deals by engaging relevant advisors, who will help mitigate risks for foreign buyers by working with them through a transparent process. As BDA has a local team in Vietnam, we have been fortunate and pleased to be trusted by many local business owners and have given them advice and helped them run structured deal processes along the way.

We remain confident in the availability of opportunities in Vietnam’s M&A market. From a macro level value creation process perspective, Vietnam will continue to enjoy: (i) stable, unparalleled economic growth compared to other Southeast Asia countries, especially amid Covid-19; (ii) an influx of advantages from recent free trade agreements; and (iii) a strong government push to equitize State-owned enterprises. From a micro-level perspective, Vietnamese companies are becoming more professional with stronger management teams and better corporate governance. They are more open to foreign investors as they see the different values that both strategic and financial investors can bring.

Anticipated M&A deals and volume in next six months

Companies looking to position themselves for recovery in the post-pandemic economy will need new capital injections for internal transformation and further growth to remain competitive, and they will be eager to restart conversations with buyers for deals that were put on hold or lost. Within businesses in industries such as F&B, manufacturing, and industrials that have been negatively affected by the pandemic, there are still a lot of sizable and high-quality assets in the market. This environment will create opportunities for an increase in deal flow linked to dislocation, as sellers are more willing to close deals at a lower valuation in exchange for immediate access to growth capital. Until travel restrictions are loosened, local investors will have an advantage over foreign counterparts in such transactions, given their presence in Vietnam and their ability to run quicker processes and provide liquidity to businesses in need. We also expect to see a consolidation trend in M&A transactions, as market conditions have become challenging for small and medium-sized enterprises (SMEs).

About BDA Partners

BDA Partners is the global investment banking advisor for Asia. We are a premium provider of Asia-related advice to sophisticated clients globally, with 25 years’ experience advising on cross-border M&A, capital raising, and financial restructuring. We provide global reach with our teams in New York and London, and true regional depth through our seven Asian offices in Mumbai, Singapore, Ho Chi Minh City, Hong Kong, Shanghai, Seoul and Tokyo. BDA has deep expertise in the Chemicals, Consumer & Retail, Health, Industrials, Services and Technology sectors. We work relentlessly to earn our clients’ trust by delivering insightful advice and outstanding outcomes. BDA Partners has strategic partnerships with William Blair, a premier global investment banking business, and with DBJ (Development Bank of Japan), a Japanese government-owned bank with US$150bn of assets.

US securities transactions are performed by BDA Partners’ affiliate, BDA Advisors Inc., a broker-dealer registered with the Securities and Exchange Commission (SEC). BDA Advisors Inc. is a member of the Financial Industry Regulatory Authority (FINRA) and SIPC. In the UK, BDA Partners is authorised and regulated by the Financial Conduct Authority (FCA). In Hong Kong, BDA Partners (HK) Ltd. is licensed and regulated by the Securities & Futures Commission (SFC) to conduct Type 1 and Type 4 regulated activities to professional investors. www.bdapartners.com

Huong Trinh, Managing Director and Head of Ho Chi Minh at BDA Partners, shares insights on Vietnam M&A market, including growth sectors, cross-border activity, digitalization, and the rise of SPACs.

Which industries do you see picking up in the SE Asia region, largely with the focus on Vietnam?

Internet-related businesses have been growing rapidly of late. Consumer behaviour is changing, and this is a long-term sustainable shift in consumer dynamics. Average order value on e-commerce sites rose by over 35% year-on-year in the first half of this year.

For the industrial sector, COVID-19 has been certainly a catalyst for business owners to consider a transaction. The underlying reason was the fundamental change in the economic outlook domestically and globally, which has urged a number of investors to look for a more stable and “safer” destination while its business owners see the

benefits of having a “big brother” who is financially stronger with them to grow the business, especially during unstable periods.

Healthcare is another attractive sector for investors. The sector will likely see lower cash flow compared to 2019. Hospitals face a huge negative impact on revenue as they have had to cancel many profitable surgeries and procedures, while investing more in staffing and getting extra protection equipment for work. In contrast, personal protective equipment companies are seeing a significant revenue growth and the pharmaceutical sector will continue to grow strongly post-pandemic.

Industrial real estate and logistics will also grow, thanks to multinational companies shifting their manufacturing base from China, and the requirement for logistics and supply chains to keep up.

Sectors that have been temporarily hit by COVID-19, such as food & beverage, hospitality and discretionary retailing, present opportunities at attractive valuations for buyers who are confident of a strong bounce back.

How do you see international investors completing transactions with Vietnam’s borders still shut?

We signed/completed 5 transactions so far since COVID-19 without the buyers coming into Vietnam for the signing/closing.

This has been a key concern when COVID-19 started, but as we came along it is really a matter of how much both sides like the deal and how we, as the advisor, add value. We see that people have been very creative in the process, for example the investor can hire a local advisor to do the site visit/management meeting on the ground in Vietnam, the local team can take high-quality video on the assets, etc. These creative approaches will help very much to get the deals done.

We at the BDA Ho Chi Minh City office are observing a large demand for growth capital and exits from both founder-backed and private equity-owned companies, evidenced by numerous current live deals and strong pipelines/opportunities for 2021.

What are the trends you see in cross-border activity?

Compared to a decade ago, perception towards M&A has changed drastically among business owners, government agencies and investors/buyers in a positive way. As Vietnam’s economy opens up, we have witnessed more and more large cross-border deals that brought positive growth to the target companies and benefits to all stakeholders. We see people are taking a much more structured approach for large domestic deals or cross-border deals which require the involvement of all relevant advisors as they see the benefits of having an official process and advisors in place:

- better positioning the company

- consistent and organised approach

- more competitive process can create better valuation and terms

- increase the certainty

- professional advice will definitely help get better outcome and reduce risks

As BDA has a local team in Vietnam, we have been fortunate and pleased to be trusted by many local business owners to give them advice and help them run a structured process along the way.

Discuss the growth of digitization especially in the M&A environment in SE Asia?

Overall – the digital economy has been growing exponentially. The COVID-19 pandemic, for all its negative impacts on health, society and economy, is expediting the growth of Vietnamese e-commerce and digital finance, paving the way for the country to fulfill its digital potential. Traffic on e-commerce platforms in 2020 was 150 percent higher than the previous year, with approximately 3.5 million visitors per day on various platforms.

Can you comment on the rise of SPACs?

There are tremendous benefits of considering a SPAC buyer in a sale process, opening opportunities for growing companies in developing markets that wish to participate in other established markets’ capital markets:

- Valuation: Robust public market valuation with retail participant

- Speed to market: Ability to secure capital commitments within 4-6 weeks vs. IPO with 3-4 months of market risk before roadshow

- Certainty: Less sensitive to general equity backdrop and market windows

- Flexibility: Ability to fully disclose financial forecasts to support investment case; Structural flexibility for integration of earn outs/conditional fees and more incentive driven deal constructs

About BDA Partners

BDA Partners is the global investment banking advisor for Asia. We are a premium provider of Asia-related advice to sophisticated clients globally, with 25 years’ experience advising on cross-border M&A, capital raising, and financial restructuring. We provide global reach with our teams in New York and London, and true regional depth through our seven Asian offices in Mumbai, Singapore, Ho Chi Minh City, Hong Kong, Shanghai, Seoul and Tokyo. BDA has deep expertise in the Chemicals, Consumer & Retail, Health, Industrials, Services and Technology sectors. We work relentlessly to earn our clients’ trust by delivering insightful advice and outstanding outcomes. BDA Partners has strategic partnerships with William Blair, a premier global investment banking business, and with DBJ (Development Bank of Japan), a Japanese government-owned bank with US$150bn of assets.

US securities transactions are performed by BDA Partners’ affiliate, BDA Advisors Inc., a broker-dealer registered with the Securities and Exchange Commission (SEC). BDA Advisors Inc. is a member of the Financial Industry Regulatory Authority (FINRA) and SIPC. In the UK, BDA Partners is authorised and regulated by the Financial Conduct Authority (FCA). In Hong Kong, BDA Partners (HK) Ltd. is licensed and regulated by the Securities & Futures Commission (SFC) to conduct Type 1 and Type 4 regulated activities to professional investors. www.bdapartners.com

Simon Kavanagh, Partner and Head of Industrials at BDA, shares his views on where we will see the most M&A activity within Industrials in Asia, in terms of sub-sectors, markets and key players in 2021 and beyond.

– Which are the most active sub-sectors in Industrials in Asia in terms of M&A activity since 2020?

There are two sub-sectors within Industrials where we’re certainly seeing a lot of activity. One is general component manufacturing, both metal components and plastic components. The automotive sector in particular has rebounded from a low in 2020, and we are seeing several deals in the marketplace currently. Component manufacturing then extends up into EMS and assembly, and there’s quite a lot of focus on electronic components, especially where there’s a technology angle.

The general trend for 2021 onwards is that technology is key. The R&D capabilities of target companies are scrutinized very closely by investors and the extent of their technology expertise has a meaningful impact on valuation. For pure play component manufacturing companies, with less of a technology angle, there is less demand, and appetite and valuations are lower.

Another sub-sector where we are starting to see increased activity is in waste recycling. This ties into the general mega theme towards ESG, which is becoming an attractive investment sector and one which funds and LPs are actively looking for opportunities.

– At the end of 2020, BDA closed a milestone transaction in the semiconductor sector with the sale of Compart to Shanghai Wanye. Compart is a leading global supplier of semiconductor components and assemblies, headquartered in Singapore with manufacturing plants in China and Malaysia. Do you see more opportunities in this subsector? Who are the most active investors?

The sale of Compart was a very successful transaction, for both buyer and seller. The investment environment is strong and there are several additional semiconductor related transactions coming to the market. BDA is currently working on a number of these, each in a different stage of the semiconductor manufacturing supply chain.

China has made it a priority to strengthen its domestic semiconductor capability and Chinese companies are keen acquirers. There is a strong willingness for Chinese corporates to borrow money and for private equity firms to commit capital to semiconductor related targets.

We expect the Chinese pace of investment in the semiconductor sector to continue for the next few years. It is an industry where most of the manufacturing and the technology is outside of China, either in Taiwan, Korea or the US. So there is a strategic value to the companies they are buying, even if valuation is relatively high. Private equity firms specialising in the semiconductor sector have sprung up. Wise Road Capital is one of the better-known ones: earlier this year it acquired MagnaChip in Korea for US$1bn. It was unusual for a Chinese company to buy something in Korea of that size, but it followed their 2020 acquisition of United Test and Assembly Center.

– How do you view the acquisition appetite of financial sponsors versus strategic investors for the Asian Industrials sector?

Financial sponsors have the upper hand at the moment and that will continue throughout 2021, until the macroeconomic environment stabilises and travel restrictions are lifted. The investor universe for industrial companies is weighted quite heavily towards Asian financial sponsors, with some activity and interest from Asian strategics. However, financial sponsors are much more flexible in terms of considering cross border M&A in the Covid-19 environment and being able to complete due diligence virtually.

Sponsor investors across the board are looking to increase their exposure to the region. Several international private equity firms have raised large Asia-only focused funds since 2020, including KKR, Blackstone and Carlyle. China-focused private equity firms (Boyu, Primavera, Fountainvest, BPEA, Hillhouse and PAG) are also investing or raising billion-dollar funds.

Strategic investors tend to be a little more conservative. It has not been a priority for US or European corporates to make significant investments in Asia these past couple of years: they have tended to focus on their home markets. The difficulty of doing site visits under the current Covid-19 travel restrictions has more of an impact on them, than on financial investors. However, while it is early stages, BDA is starting to see a change in the trend with a noticeable increase in the number of corporate clients calling us in 2021 to discuss buyside roles in Asia.

– China outbound M&A in 2020 was the lowest level in the last decade. Do you still see Chinese investors having a conservative view in outbound industrial deals in 2021?

The volume of China outbound M&A has come back from the low of 2020. Outbound volume in Q1 2021 was up 15.9% YoY. But in general, yes, the heyday of Chinese outbound diversification has gone. US assets are still out of favor due to geopolitical tensions. Europe is attractive, but acquirers are far more cautious, both in terms of what they buy and how much they pay for it.

When they do make acquisitions it’s the technology that is most critical. China’s next stage of development is very much towards being at the forefront of technological leadership and R&D capabilities. They are looking at what this target can bring to them in the industry. Does it have something that is not essentially in China already? What can a new Chinese owner do to win Chinese customers for this foreign company? Does the target company have some special intellectual property or is it the leading expert in a particular niche? Technology will remain the key driver for outbound M&A for many more years.

– SPACs have been a hot topic recently. What impact do you think SPACs will have on the industrial sector in Asia?

Not much of an impact. SPACs tend to focus on high growth companies that are looking at raising capital and want to do an IPO, but are less suited to the more traditional routes for public listing. There are not many industrial companies that fall into that category. Local Asian SPACs are still not regulated or available / approved by regulators in either Hong Kong or Singapore, although that will change in due course. In order to pursue the SPAC route in either the US or Europe, the business needs to be big, like Grab. But if you’re a US$1 billion valuation Industrials company, you won’t need to sell new shares to raise capital, and if you’re looking for liquidity you will probably just go and do a normal route IPO or sell to a financial sponsor.

– Is the shift of manufacturing capacity to Vietnam, at the expense of China, continuing?

Yes, the trend will continue for the foreseeable future. Vietnam still has a significant cost advantage over China, particularly for labor-intensive industries. Companies are not necessarily moving their entire supply chain from China to Vietnam, but if they are adding capacity, it’s less likely that they will be making that capital expenditure in China. Vietnam, as well as Malaysia to some extent, are continuing to benefit because of their well-qualified workforce of engineers and a friendly FDI regulatory environment.

With our strong BDA Partners team on the ground in Vietnam, we are seeing and working on a lot of founder-owned sellside transactions where the target companies are very attractive bolt-on acquisitions for strategic investors. We’re witnessing the start of a shift, where a generation of founders of some very successful Vietnamese companies are looking for liquidity, and they need access to an international investor universe and an advisor to help guide them through an M&A process.

About BDA Partners

BDA Partners is the global investment banking advisor for Asia. We are a premium provider of Asia-related advice to sophisticated clients globally, with 25 years’ experience advising on cross-border M&A, capital raising, and financial restructuring. We provide global reach with our teams in New York and London, and true regional depth through our seven Asian offices in Mumbai, Singapore, Ho Chi Minh City, Hong Kong, Shanghai, Seoul and Tokyo. BDA has deep expertise in the Chemicals, Consumer & Retail, Health, Industrials, Services and Technology sectors. We work relentlessly to earn our clients’ trust by delivering insightful advice and outstanding outcomes. BDA Partners has strategic partnerships with William Blair, a premier global investment banking business, and with DBJ (Development Bank of Japan), a Japanese government-owned bank with US$150bn of assets.

US securities transactions are performed by BDA Partners’ affiliate, BDA Advisors Inc., a broker-dealer registered with the Securities and Exchange Commission (SEC). BDA Advisors Inc. is a member of the Financial Industry Regulatory Authority (FINRA) and SIPC. In the UK, BDA Partners is authorised and regulated by the Financial Conduct Authority (FCA). In Hong Kong, BDA Partners (HK) Ltd. is licensed and regulated by the Securities & Futures Commission (SFC) to conduct Type 1 and Type 4 regulated activities to professional investors. www.bdapartners.com

We spoke with Howard Lee, Partner and Head of Seoul at BDA Partners, who discussed the outlook of the M&A activities in South Korea, the impressive growth of the Korean private equity market and the role of a great financial advisor.

- What are the latest trends in the M&A inbound and outbound market in South Korea?

Inbound acquisitions of Korean assets by foreign investors have been inactive over the past year. It is largely related to the impact of Covid-19 on overseas buyers. For example, when I talked to potential buyers in the US or China about Korean assets, the general feedback was, under the Covid situation, we were unable to organize ourselves to seriously look at the asset. The Korean inbound market will be more active when the Covid situation improves globally during 2021.

Also, overseas acquisitions by Korean companies in the US and European market have not been particularly active over the last decade. Only few top conglomerates in Korea, like Samsung, LG and SK, tend to execute such M&A transactions. In general, most Korean companies tend to take a conservative stance when it comes to allocating considerable resources for cross-border M&A transactions. The problem resides in their limited exposure to cross-border M&A as well as in post transaction steps such as PMI (Post-Merger Integration). Thus, in order to penetrate overseas market through M&A strategy, it is important that they approach and confront the deal confidently but with proper preparation. Secondly, out of those major conglomerates, their hands are tied up by regulations. So, even though they would intend to go out looking at M&A opportunities, there are sometimes issues at the corporate level or sometimes at the level of key individuals.

- What are the key factors to the rising presence of financial sponsors in the Korean market?

Korean financial sponsors are quite capable, in terms of sourcing capital and executing transactions. Most Korean financial sponsors are supported by large limited partners such as the National Pension Service, the largest public pension fund in South Korea. As private equity funds continue growing in Korea, they are pressured to invest capital and make investments. Moreover, the Korean private equity market is relatively mature compared to other Asian countries and the private equity professionals are very capable and intelligent, exerting high level of professionalism in sourcing high quality assets and undertaking extensive due diligence.

The growth of Korean private equity has quite a unique story. In Korea, conglomerates divest certain affiliates every year. However, for various cultural reasons, transaction between corporates in Korea is very rare. For example, if Samsung sells one of its affiliates to LG, it would be considered exactly a kind of betrayal to employees. So, rather than directly selling the affiliate to another corporate, they would likely have an indirect discussion and sell it first to a private equity fund. A few years later under private equity ownership, the fund would then sell the asset to another conglomerate. This is a pretty typical process in Korea, and that is why financial sponsors are very active in acquiring assets, without many challenges divesting to corporates a few years later.

- Korean M&A market is expected to face an unprecedented boom in 2021. What are your views for the Korea M&A market in 2021?

The expected booming M&A activities in 2021 will be largely driven by the pent-up in transactions. Many private equity funds had good assets ready to be divested in 2020 but the M&A process was disrupted by Covid-19. These funds are now looking to resume these M&A processes in 2021. We will likely see a number of large assets come to the market in 2021. In the case of corporates, their outbound investments in the US, Japan and European markets have also been put on hold because of Covid. As we were seeing the light at the end of the tunnel by the end of 2020, these activities are also likely to resume during 2021.

As far as my knowledge goes, the market has already begun its process to rejuvenate M&A activities. A number of advisors/bankers are already in the process of developing deals and we can soon expect the market to be flooded with deals.

- How have chaebols (large local conglomerates) changed over the last few years and what do you expect going forward?

In my perspective, each chaebol has been focusing on building up their internal taskforce in 2020 looking to identify and resolve potential in-house issues related to liquidity, financial performance, etc. As a result, there were no significant transactions in 2020, other than SK Hynix’s acquisition of Intel’s NAND memory business for US$10bn.

For the past few years, chaebols were not active about overseas M&A. However, they now realize the future depends on their capabilities in AI, semiconductor, data, platform business, etc. As evidenced by Hyundai Motors’ recent investment in a global robotics company in the US, I think that these kinds of investment and acquisition by chaebols will be flourishing going forward.

- What are the most attractive sectors in Korea for M&A over the next five years and why?

One of the most attractive sectors in M&A over the next five years will be the industrials sector as it needs to be consolidated or restructured. Large industrials companies in Korea such as Samsung, LG and SK will need to complete some consolidation or restructuring, whether it is acquiring a competitor or exiting this sector soon in preparation for the ESG era. Based on the expected market dynamics as mentioned above, there will be a myriad of acquisition opportunities of legacy business under the consolidation or ESG preparation.

In addition, other attractive sector to look out for is the tech-driven industry which Korean chaebols and conglomerates are focusing on at the moment. Businesses related to AI, data, cloud computing, semiconductor are the ones that the conglomerates not only have strong fundamental on but also heavily investing in as well.

- How do you think the role of M&A financial advisory will evolve under such fierce competition?

Over the past decade, I think the top five or six conglomerates in Korea accounted for more than 80% of the fees paid to M&A financial advisors. That is because those conglomerates have sizable revenues and there are many M&A deals being sourced from them. In recent years, the private equity sector has been growing fast, contributing more and more to the financial advisory business across Korea.

Therefore, an advisor needs to focus on these two client types, and be able to deliver what they require. Corporate clients value the advisory firm’s network in both domestic and global markets. Private equity clients tend to look at each individual banker, their capabilities and track record for instance. So, I think M&A financial advisory needs to be built up in these two ways. Any advisory firm that is successful in building extensive local and global networks, and continuing to hire great professionals, will end up in a better position compared to the competition.

Another perspective here is the M&A financial advisory firms need to act like a bridge between corporates and private equity funds. If we build up a private pipeline between the two, we can arrange the one-on-one deal between private fund and corporate.

BDA has an edge in our unparalleled local Korean and global networks, extended experience in sell-side process, and seamless execution by the global team of professional bankers. Going forward, BDA Seoul will keep hiring highly competent people and delivering bigger transactions.

In this light, BDA Seoul is currently in discussion with a U.S. law firm to help Korean corporates elevate their knowledge of rules and practices to be considered when acquiring U.S. publicly-listed companies and will hold a session in March where all M&A staffs from most of major corporates in Korea will be invited. I believe this will greatly improve our reputation in the Korean market and strengthen our relationship with the potential clients.

About BDA Partners

BDA Partners is the global investment banking advisor for Asia. We are a premium provider of Asia-related advice to sophisticated clients globally, with 25 years’ experience advising on cross-border M&A, capital raising, and financial restructuring. We provide global reach with our teams in New York and London, and true regional depth through our seven Asian offices in Mumbai, Singapore, Ho Chi Minh City, Hong Kong, Shanghai, Seoul and Tokyo. BDA has deep expertise in the Chemicals, Consumer & Retail, Health, Industrials, Services and Technology sectors. We work relentlessly to earn our clients’ trust by delivering insightful advice and outstanding outcomes. BDA Partners has strategic partnerships with William Blair, a premier global investment banking business, and with DBJ (Development Bank of Japan), a Japanese government-owned bank with US$150bn of assets.

US securities transactions are performed by BDA Partners’ affiliate, BDA Advisors Inc., a broker-dealer registered with the Securities and Exchange Commission (SEC). BDA Advisors Inc. is a member of the Financial Industry Regulatory Authority (FINRA) and SIPC. In the UK, BDA Partners is authorised and regulated by the Financial Conduct Authority (FCA). In Hong Kong, BDA Partners (HK) Ltd. is licensed and regulated by the Securities & Futures Commission (SFC) to conduct Type 1 and Type 4 regulated activities to professional investors. www.bdapartners.com

Euan Rellie, Co-Founder and Senior Managing Director of BDA, in New York, recently joined a webinar International Business Briefing: What is the Future of the China Market, hosted by the US-China Business Council and Faegre Drinker.

Euan shared insights on M&A trends in China and Asia:

- China M&A Overview

- In 2019, China-related M&A transactions slumped significantly, reaching the lowest transaction value since 2013

- Major drivers were: Drop in outbound M&A (dropped 37% in value) and Drop in Private equity deals (dropped 22%)

- Outbound deals have been discouraged by increased scrutiny of CFIUS review in the US; national security review in Europe; Beijing’s controls on outbound capital flows

- Inbound transactions reached US$20bn in 2019, representing a 5.6% growth YoY

- China as a market for US companies: Large inbound acquisitions in China have always been rare; acquisitions by US companies have mostly been small/medium sized

- Impact of the trade war: Punitive actions against China will continue. Even if Trump loses in November, investors don’t expect a significant change in the US approach to China. The tone and tactics will change

- Developments during the pandemic: China becomes a refuge for US companies after overcoming COVID-19. China’s economy is slowly recovering, growing by 3.2% in Q2 2020 as retail and luxury sales experience a strong rebound. The recovery is unbalanced, which has widened the wealth gap

- Hong Kong isn’t over for foreign investors, despite the National Security Law: Hong Kong will remain the hub for inbound and outbound mainland investments

- China M&A going forward:

- In the short term, Chinese investors will be focused on domestic consolidation and less active in outbound M&A. Growth in inbound deals is expected, but a red-hot IPO market and high valuations in China could prevent this from growing fast

- In the medium/long term, we expect frequent sales of family-owned businesses. As China faces rising tension with the US, the PRC Government work to ease regulations on inbound M&A

If you want a copy of the slides, or would like to discuss any of these topics, please contact us.

About BDA Partners

BDA Partners is the global investment banking advisor for Asia. We are a premium provider of Asia-related advice to sophisticated clients globally, with over 24 years’ experience advising on cross-border M&A, capital raising, and financial restructuring. We provide global reach with our teams in New York and London, and true regional depth through our seven Asian offices in Mumbai, Singapore, Ho Chi Minh City, Hong Kong, Shanghai, Seoul and Tokyo. BDA has deep expertise in the Chemicals, Consumer & Retail, Health, Industrials, Services and Technology sectors. We work relentlessly to earn our clients’ trust by delivering insightful advice and outstanding outcomes.

BDA Partners has strategic partnerships with William Blair, a premier global investment banking business, and with DBJ (Development Bank of Japan), a Japanese government-owned bank with US$150bn of assets.

US securities transactions are performed by BDA Partners’ affiliate, BDA Advisors Inc., a broker-dealer registered with the Securities and Exchange Commission (SEC). BDA Advisors Inc. is a member of the Financial Industry Regulatory Authority (FINRA) and SIPC. In the UK, BDA Partners is authorised and regulated by the Financial Conduct Authority (FCA). In Hong Kong, BDA Partners (HK) Ltd. is licensed and regulated by the Securities & Futures Commission (SFC) to conduct Type 1 and Type 4 regulated activities to professional investors. www.bdapartners.com

We spoke to Huong Trinh, Managing Director and Head of the BDA Partners Ho Chi Minh City office, about the latest exciting developments in M&A in Vietnam.

You worked on the largest inbound private sector industrial transaction in Vietnam in the last three years, the sale of Thipha & Dovina to Stark Corporation, for US$240m. Why were Thipha & Dovina such an attractive investment opportunity for an international buyer?

Thipha & Dovina are a leading electric cable and non-ferrous metal group with a 30-year history. The companies grew revenues at an average 20% per annum for the period 2015-2019, and revenue exceeded US$500m.

This asset offers direct exposure to Vietnam’s economic growth. Vietnam has been emerging as a manufacturing hub in the region given its relatively low labor cost and strategic location. In 2019, Vietnam recorded GDP growth of ~7%, and is expected to remain a regional outperformer. Significant investment in infrastructure is underway. The government and business led spending will drive demand for cable and wiring for the foreseeable future.

Thai buyers are consistently interested in Vietnamese assets, and have made several significant investments in Vietnam over the last few years.[1]

Do you think there will continue to be inbound interest in Vietnamese companies from the rest of Asia and further afield in the future? If so, what are the key reasons?

Obviously yes, as we have received lots of indications of interest for high-quality industrial assets, as well as other sectors, from both global and regional buyers. We believe the strong inbound interest is mostly driven by the following factors:

- Vietnam’s economy is driven by consumer spending, which accounts for close to 70% of its GDP. With the third largest population in ASEAN, and the expansion of upper and middle-income earners, the economy is expected to grow further. Despite the disruption from COVID-19, Vietnam is expected to still enjoy ~3% economic growth this year and is expected to bounce back to 6% growth in 2021[2]

- Vietnam will benefit from recently signed Free Trade Agreements (CPTPP & EVFTA), which encourage more foreign direct investment into the country and put in place lower tariff structures. This is also an indicator of strong EU-Vietnam relations

- Vietnam has been emerging as a manufacturing hub in the region given its relatively low labor cost, but with increasing quality and a strategic location with many seaports nationwide. Global companies started shifting operation to Vietnam in 2010, and this trend has been accelerated by the ongoing US-China trade tensions

Are there opportunities in Vietnam for BDA to sell founder owned businesses in the future?

We believe there are still many more opportunities in Vietnam to advise founders on the sale of their businesses in the short term. There are still a lot of sizable and high-quality assets in the market that have grown into market leaders over the course of several decades and which have undergone different phases of development. They may need a new “growth engine” or investment to remain competitive and in some cases the founders are simply looking to exit and step back from the company they founded.

In addition, improved legal framework and corporate governance are making it easier and more transparent for foreign investors, giving them greater confidence to acquire majority stakes.

We are currently mandated on a number of projects thanks to: (i) a combination of our strong relationship with both strategic and financial sponsor buyers because of our global network; (ii) a senior team on the ground in Vietnam (especially important during COVID-19); and (iii) excellent execution capabilities which are laser-focused on delivering the best outcome for our clients.

Which will be the most attractive sectors in Vietnam for M&A in the post COVID-19 environment and why?

Internet-related businesses have been growing rapidly during COVID-19. Online, or online-to-offline, products and services have seen significant growth. This is not just a short-term effect; consumer behaviour is changing, and this is a long-term sustainable shift in consumer dynamics. Average order value on e-commerce sites rose by over 35 percent year-on-year in the first half of this year.

People are still spending money on shopping, a good sign given the fears that demand would fall during the COVID-19. The best performer was the groceries and fresh food, following by household supplies, homecare and healthcare products. Shopping malls are now packed with people like COVID-19 was never here.

For the industrials sector, COVID-19 has been certainly a catalyst for business owners to consider a transaction. The underlying reason was the fundamental change in the economic outlook domestically and globally, which has urged a number of investors to look for a more stable and “safer” destination whilst business owners see the benefits of having a “big brother” who is financially strong together with them to grow the business, especially during the unstable periods.

Healthcare is another attractive sector for investors. Some of the healthcare sub-sectors are performing well during COVID-19, while some are not. The sector will likely see lower cash flow in 2020 compared to 2019. Hospitals face a huge negative impact on revenue as they have had to cancel many profitable surgeries and procedures, while spending more on staffing and getting extra protection equipment for work. In contrast, personal protective equipment companies are seeing significant revenue growth, and the pharmaceutical sector will continue to grow strongly post pandemic.

Industrial real estate and logistics will also grow, thanks to multinational companies shifting their manufacturing base from China, and the requirement for logistics and supply chains to keep up.

Sectors that have been temporarily hit by COVID-19, such as food & beverage, hospitality and discretionary retailing, present opportunities at attractive valuations for buyers who are confident of a strong bounce back after COVID-19.

Do you see any changes in perception towards M&A processes in Vietnam? Have handshake deals been completely replaced by more structured processes?

Compared to a decade ago, the perception towards M&A has been changed drastically among business owners, government agencies and investors/buyers in a positive way. As Vietnam’s economy has opened up, we have witnessed more and more large deals that have brought positive growth to the target companies and benefits to all stakeholders. As awareness of the positive benefits of M&A has grown, shareholders are now more open to adding M&A as a strategic option in their growth trajectory and strategy. Sellers are becoming more educated in terms of an M&A process and key concepts. I still remember 15 years ago, it took me a lot of time to explain to the business owners how investors would value a business, which was not only based on how many land use rights the company held or how famous their company was.

For small deals, or deals between two domestic parties, handshake deals are still common, with all the decisions being made quickly, top down. However, we see people are taking a much more structured approach for medium and large domestic deals or cross-border deals. These deals will involve a variety of advisors as shareholders see the benefits of having an official process and professional advice: (i) better positioning the company; (ii) consistent and organised approach; (iii) a more competitive process will result in better equity valuation and terms; and (iv) increase the certainty of the deal completing and reduce the associate deal risks.

As BDA has a local team in Vietnam, we are happy to be trusted by local business owners to give them advice and help them to run a structured M&A process.

How do you see international investors completing transactions with Vietnam’s borders still shut?

BDA has signed and/or completed three transactions so far in 2020 without the buyers coming into Vietnam for the closing/signing.

This was a key concern when COVID-19 started, but as things have progressed, it is really a matter of how much both sides like the deal and how we, as the advisor, add value. We have been very creative with our sale processes. For example, helping the investor hire a local advisor to do the site visit/management meeting on the ground in Vietnam; arranging for the seller to take high-quality videos of the factories and assets, and so on. These creative approaches help to get deals done.

According to the AVCJ, 2019 was a record year for the number of PE / VC investments in Vietnam. Do you expect to see a rise in domestic and international private equity investment in Vietnam continuing in 2020 and 2021?

From a macro level value creation process perspective, Vietnam will continue to enjoy: (i) stable, unparalleled economic growth compared to other Southeast Asia countries, especially amid the COVID-19 situation; (ii) an influx of advantages from the recent free trade agreements; and (iii) strong government push to privatize state-owned enterprises. From a micro-level perspective, Vietnamese companies are getting more professional with stronger management teams and better corporate governance. They are more open to foreign investors as they see the different values that both strategic and financial investors can bring to the companies.

There is increasing demand for growth capital in 2020-2021. The private sector in Vietnam, with its strong momentum, will need more capital to pursue transformational changes and achieve further growth. The start-up ecosystem is seeing robust expansion, with internet related companies as the most attractive sector.

We, at the BDA Partners Ho Chi Minh City office, are seeing strong demand for growth capital and exits from both founder-backed and private equity owned companies. This is visible from our numerous live deals and strong pipeline/opportunities for 2021.

Contact us for more details on the insights

[1] In 2014, Berli Jucker Pcl announced a US$879m transaction to acquire Metro Cash & Carry Vietnam. In 2015, Central Group through its subsidiaries, Power Buy, bought 49% stake in Nguyen Kim Trading Company. In 2016, Central Group acquired Big C Vietnam, a supermarket chain, with a transaction value of US$1.0bn. In 2017, ThaiBev Group, through its subsidiary Vietnam Beverage, has acquired majority stake in Sabeco, Vietnam’s largest brewery company, with a deal size of US$4.8bn. SCG, a Thailand conglomerate, has done a number of transactions in construction materials and packaging in Vietnam.

[2] HSBC research shows Vietnam enjoying very strong internal domestic demand even during COVID-19. Nielsen research indicated that Vietnamese consumers remain 2nd in ASEAN in terms of being positive.

About BDA Partners

BDA Partners is the global investment banking advisor for Asia. We are a premium provider of Asia-related advice to sophisticated clients globally, with over 24 years’ experience advising on cross-border M&A, capital raising, and financial restructuring. We provide global reach with our teams in New York and London, and true regional depth through our seven Asian offices in Mumbai, Singapore, Ho Chi Minh City, Hong Kong, Shanghai, Seoul and Tokyo. BDA has deep expertise in the Chemicals, Consumer & Retail, Health, Industrials, Services and Technology sectors. We work relentlessly to earn our clients’ trust by delivering insightful advice and outstanding outcomes.

BDA Partners has strategic partnerships with William Blair, a premier global investment banking business, and with DBJ (Development Bank of Japan), a Japanese government-owned bank with US$150bn of assets.

US securities transactions are performed by BDA Partners’ affiliate, BDA Advisors Inc., a broker-dealer registered with the Securities and Exchange Commission (SEC). BDA Advisors Inc. is a member of the Financial Industry Regulatory Authority (FINRA) and SIPC. In the UK, BDA Partners is authorised and regulated by the Financial Conduct Authority (FCA). In Hong Kong, BDA Partners (HK) Ltd. is licensed and regulated by the Securities & Futures Commission (SFC) to conduct Type 1 and Type 4 regulated activities to professional investors. www.bdapartners.com